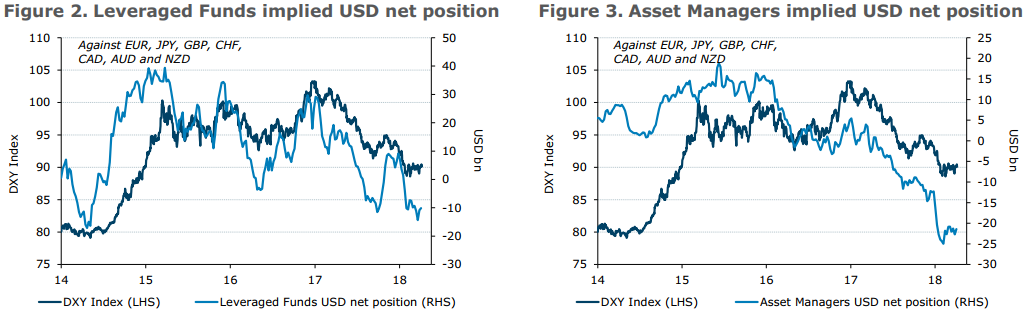

ANZ on the CFTC data (ANZ look at "combined futures and options position of Leveraged Funds as a proxy for leveraged positioning")

In brief:

Leveraged funds were net buyers of USD for the second consecutive week, amid escalating trade tensions.

- Funds trimmed their overall net short USD position by a further USD0.7bn to USD10.1bn

- Real asset managers, too, turned net buyers of the USD, reversing their position from the previous week. Their overall net shorts were trimmed by USD1.3bn to USD21.4bn

Looking ahead, USD positioning is likely to remain volatile given simmering US-China trade tensions even though both countries have said there is no trade war

However, USD buying was confined mostly against the EUR and commodity currencies.

- EUR was sold against the USD by both funds and asset managers, of USD0.6bn and USD0.3bn respectively to USD USD2.2bn and USD24.7bn. Despite this, long EUR positioning of asset managers remained at an extreme level.

More:

yen buying by leveraged funds extended to the 12th consecutive week on safe haven demand

- Funds raised their net long yen positions

- Asset managers, however, trimmed their net long JPY position for the second straight week,

GBP also saw net buying against the USD

- Funds added to their overall net long ... highest net longs since August 2014

- Asset managers however, added to their net overall GBP shorts in the week

All three commodity currencies saw net selling by leveraged funds

- NZD was sold off only marginally

- Asset managers too, were an overall net seller of commodity currencies for the third consecutive week, but selling was confined mainly to the AUD