National Australia Bank on the AUD/USD, this via eFX

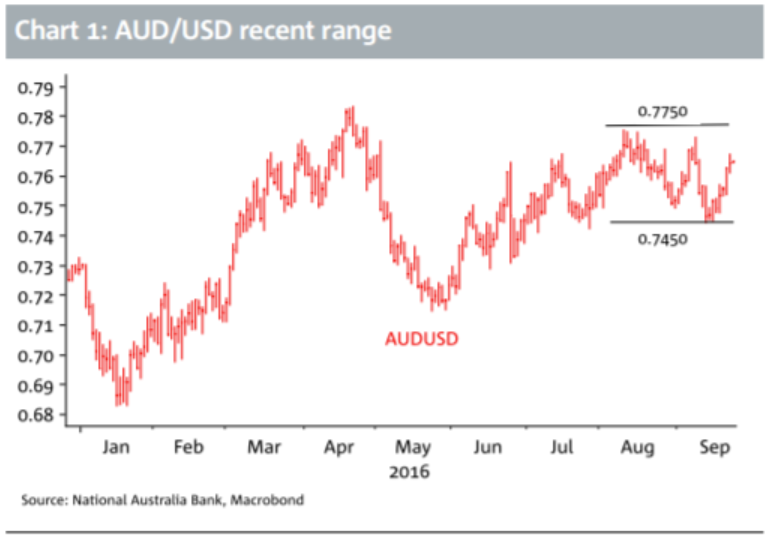

The Fed has come and gone and the US dollar has traded softer out of the FOMC, helping keep AUD/USD firmly ensconced within a 0.7450 to 0.7750 range and which has contained close to 100% of the price action since the beginning of August.

AUD/USD looks set to end the quarter not too far from our earlier 0.77 forecast and we see no compelling reason at this stage to alter our end-2016 forecast of 0.75. We're not convinced the prevailing range is under any imminent threat of breaking.

That said, post-Fed and with market volatility set to stay low at least until we get much closer to the US Presidential elections, we'd have to judge the top side as currently the weaker edge.

AUD overvalued, but so what?

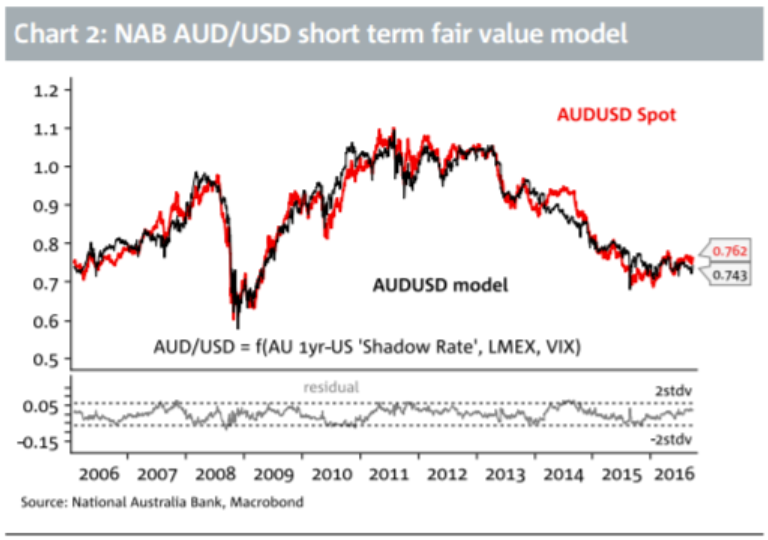

AUD/USD trades slightly rich relative to our short term fair value model estimate (just over 0.74) - but has done so for about two months now. It is significantly above the RBA's own view of the (real) trade weighted AUD that would be consistent with the scale of the terms of trade decline since its 2011 peak. In a chart contained within a speech from RBA Assistant Governor Chris Kent on 13 September, the estimated overvaluations looks to be about 6% as of Q2 and more like 8% currently. This is broadly in line with NAB's own estimates using our stylised RBA real TWI model.