Details from the October 2015 UK mortgage and consumer credit data report 30 November 2015

- Prior 68,874. Revised to 69,012

- Mortgage lending 3.629bn vs 3.450bn exp. Prior 2.595bnb. Revised to 3.562bn

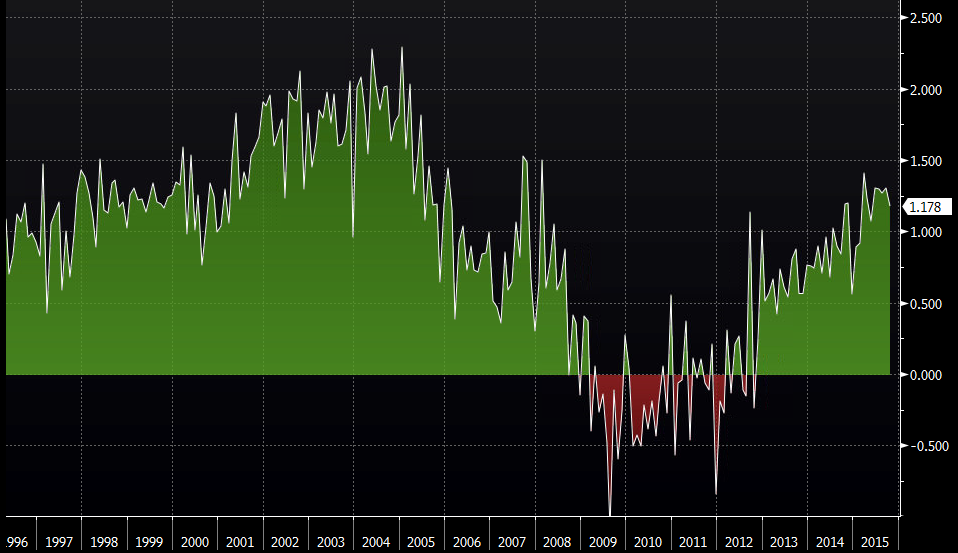

- BOE consumer credit 1.178bn vs 1.300bn exp. Prior 1.261bn. Revised to 1.303bn

- M4 money supply +0.6% vs -1.0% prior m/m

- +0.2% v s-0.6% prior y/y. Revised to -0.5%

- Ex-financials 3.7% vs 4.1% prior 3m ann

Within the consumer credit numbers, credit card debt was 257m vs 288m prior. That was revised up from 266m in Sep

Total lending to non-financial forms rose to 2.273bn vs -938m. Of that SME lending was 443m vs 246m prior

Overall household lending was down a chunk in Oct, based on the higher revision and there was some good news for general business and SME lending. The only caveat is that it's been very much up and down recently. Mortgage lending remains strong which will keep house prices aloft

UK BOE consumer credit