OPEC’s much anticipated 166th meeting is on Thursday and oil traders will be keeping close tabs on the headlines leading up to it.

There still seems to be differing rhetoric between the Saudi’s and some of the smaller OPEC members, who are facing problems from the fall in prices. The FT has a very good article citing the differences OPEC and how likely a deal is on production cuts.

The general gist is that it’s going to take a big cut of around 1.5mbpd to balance the market, and that scenario is very unlikely.

Anything other than a general agreement to cut production will probably see oil move lower again.

The FT report that even if there is some agreement there are many outcomes

It could end in open disagreement – the worst case scenario – or an agreement that any cuts would be ineffective in raising prices. If cuts are deemed necessary, the members must decide how much, for how long and over what timescale. Allocations for each producer would also need to be decided.

At the moment Brent is back into the weekly range and we’ve had some movement over the Iran nuclear talks.

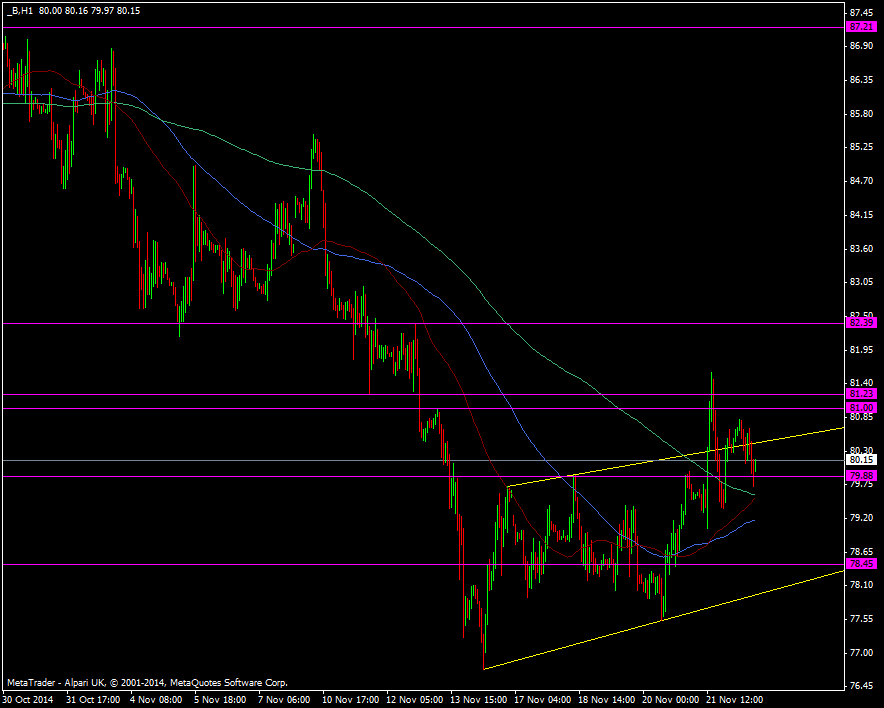

Brent crude oil hourly chart 24 11 2014

The talks have been extended until July 2015 with both sides looking for political agreements in March. For oil, an agreement in the talks would provisionally see sanctions removed and Iranian oil coming back to market, that’s more supply coming back in to add to what we’ve already got, and is another negative for prices. The caveat with Iran is that they are part of OPEC and their production numbers are accounted for in the official figures.

It’s hard to see us getting major news of production cuts but the risk is there and the market will be looking for clues. If not I can see disappointment and another leg lower for oil prices.