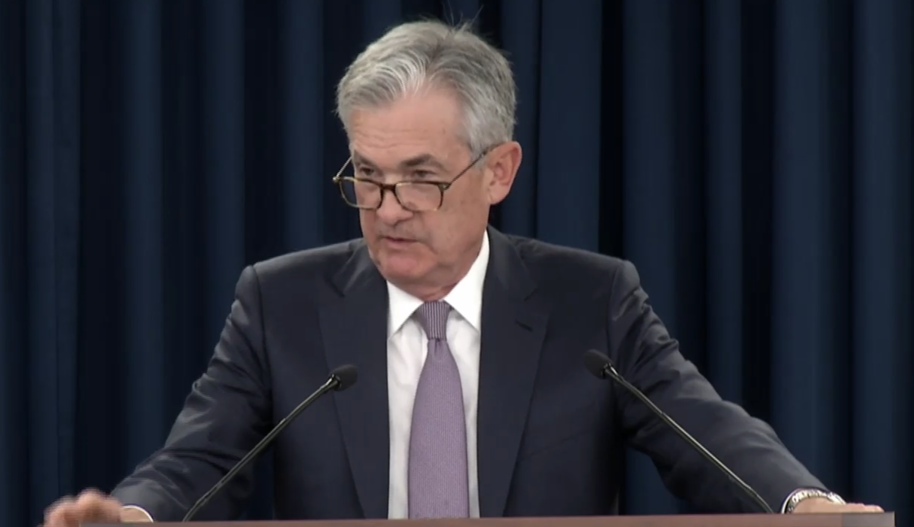

Powell answers questions from the press

- Notes that there are risks to a positive global outlook and says that if economy does turn down then deeper cuts would be appropriate

- We're going to be highly data dependent and we're not on a pre-set course

- We're going to be looking carefully meeting by meeting

- Powell particularly monitoring global growth and trade developments, we see those risks as more heightened

- This is a time of difficult judgements and disparate perspectives

- The bulk of the committee is taking decisions meeting by meeting

- Fed will be very closely monitoring market developments regarding appropriate level of reserves but there is real uncertainty

- It's certainly possible we will need to resume the organic growth of the balance sheet sooner than expected, that's always been possible

- Economy has performed roughly as expected lately

- Global economy has weakened in Europe and China

- Trade policy changes have led to big swings in sentiment in the inter-meeting period

- We are prepared to be aggressive if it turns out to be appropriate

- Household sector is in very good shape on debt

As you're watching this, you have to try to judge if Powell will ever push back against market expectations for rate cuts. it's hard to believe he is going to in October if he isn't willing to do it now.

Tim Duy points out that they're probably waiting/hoping that the data is strong enough to push rate cut expectations away but when the Fed is always moving the goalposts it's hard to pin down. One day it's data dependence, then it's inflation, the global growth, then trade. You can always find an excuse to cut.