Credit Suisse on the outlook for the euro and the ECB

Draghi today reiterated that the ECB is ready to use all the instruments available and can adjust the size of its QE program.

From Credit Suisse:

"The probability of more ECB easing appears to be on the rise given the recent weakness in macro data, including persistently low inflation, the appreciation of the euro, and the rise in outside risks affecting the euro area outlook.

Our rates strategists believe that recent announcements regarding the PSPP by the ECB are not just a response to the lack of liquidity, but likely also a sign the ECB is preparing the ground for a possible extension or acceleration of its programme.

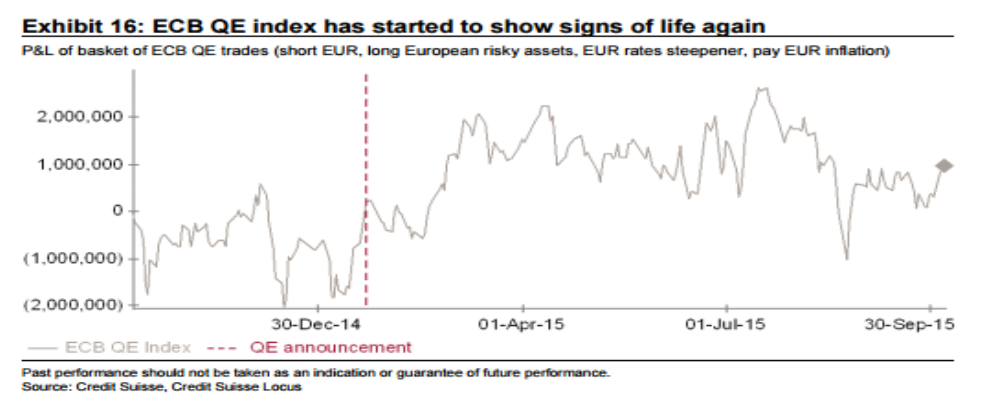

A new round of QE trades.

While some signs of the market pricing in QE extension have started to appear, most notably in the sovereign bond market, the euro remains substantially stronger compared to its lows earlier in the year - something that the ECB Governing Council evidently hasn't failed to notice, as discussed above. And European risky assets have shown signs of recovery, but are clearly off their highs following the Q3 risk sell-off, and would stand to offer significant upside if they were to trade back towards the levels seen shortly after the start of ECB asset purchases.

For investors willing to engage in a new round of QE trades at this stage, we find that selling upside in EURUSD via options offers attractive risk/reward: as our FX Strategists highlight, there is good reason to be suspicious of the euro's capacity to sustain a rally, as the ECB seems likely to keep jawboning it below the 1.15 level given the disinflationary powers still evident in the euro area.

The proceeds from the sale of EURUSD calls can be used to finance upside either on Bunds, or on European risky assets. Through such structures, investors would risk losing money only in a scenario of further euro appreciation, which is exactly what we expect the ECB to try and counteract. And if such losses were to occur, some could be offset by gains on the other leg of the structure (if Bunds, or respectively risky assets, were to rally at the same time)."

For trade ideas from banks, check out eFX Plus.