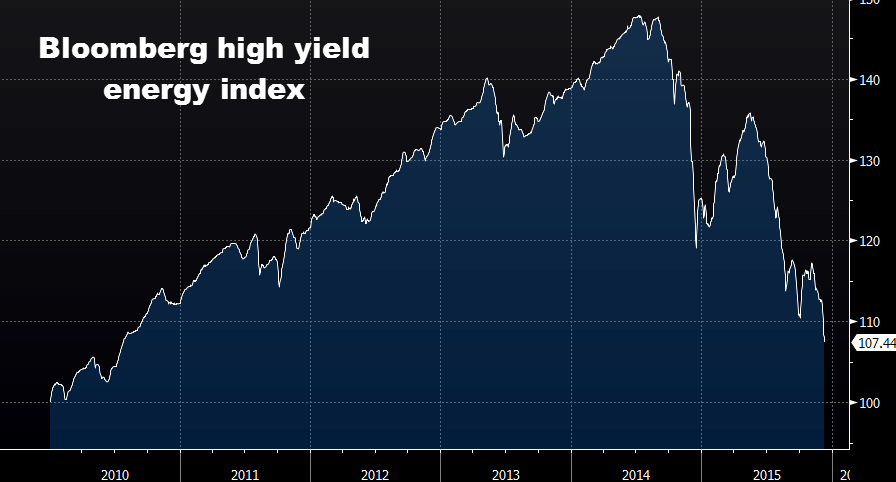

Energy junk bonds will be the first to go

If oil goes into the $20s, energy companies will default.

Just like subprime, there are many companies who should never have been lent the money. When subprime loans began to default, Bernanke famously said:

- "We do not expect significant spillovers from the subprime market to the rest of the economy"

- And that subprime is "likely to be contained"

I believe oil is headed lower from here but even at these levels, energy companies are in a world of hurt. The market is punishing their bonds.

The financial world is hoping beyond hope that any trouble is contained in energy and commodity companies but the history of subprime paints a very different picture.

There were derivatives on top of derivatives related to subprime and the whole house of cards suddenly came down and no one knew what they were doing.

"With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly," Bernanke said before the crisis.

For more on the rout in junk bonds, see: This could be the first crisis that everyone predicted