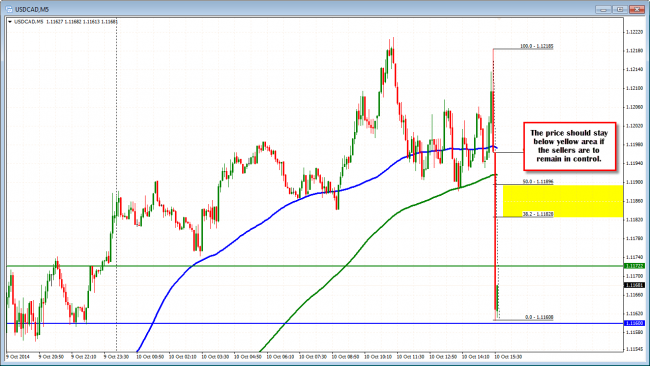

The price of the USDCAD has moved right down to the 100 and 200 hour MAs (Line in the Sand from the morning preview report) and bounced on the first look. The 50% of the days range comes in at the 1.1182-896 and this has so far held the top on the corrections off the lows (RISK – the price should not extend back above this area) . If the sellers are to remain in control (i.e. they like the downside for the pair off the better fundamentals), they should show up on rallies toward this area. A move above, and you begin to question the move and the markets conviction.

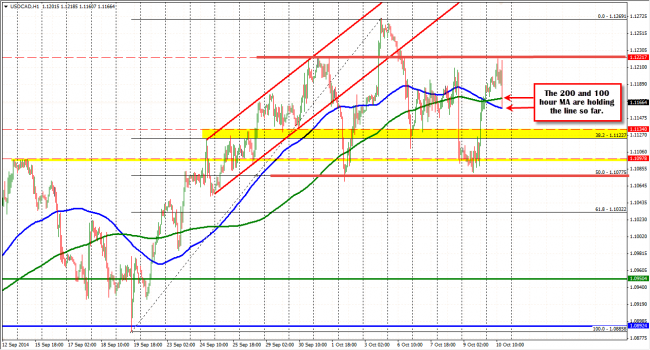

The USDCAD has been able to hold the 100 and 200 hour MA levels so far. Key level.

A move below the 1.1160 level (100 hour MA) is eyed for further downside momentum. Can traders buy against the Line in the Sand? Yes, but on a break, there should be more selling momentum, so be careful. You can also be on the lookout for failures and a reversal.

The 1.1182-1.11896 should contain the rallies if the sellers are to remain in control.