The Fed is shopping for ingredients to make a rate hike. Will the retail shelf be bare?

All the little pieces come together in the Fed interest rate mixing bowl and today we have two pieces of data from the consumer sector

First up is the retail sales report for October. Here's what to expect

- Retail sales 0.3% vs 0.1% in Sep m/m

- Ex-autos 0.4% vs -0.3% prior

- Ex-gas & autos 0.4% vs 0.0% prior m/m

- Retail control group 0.4% vs -0.1% prior

- Retail sales were +2.4% y/y in Sep

Auto sales have been keeping the numbers up but it's hard to see that lasting. No one goes out and buys a car every month. The numbers below give us a fair idea of what sales have looked like this year with autos stripped out

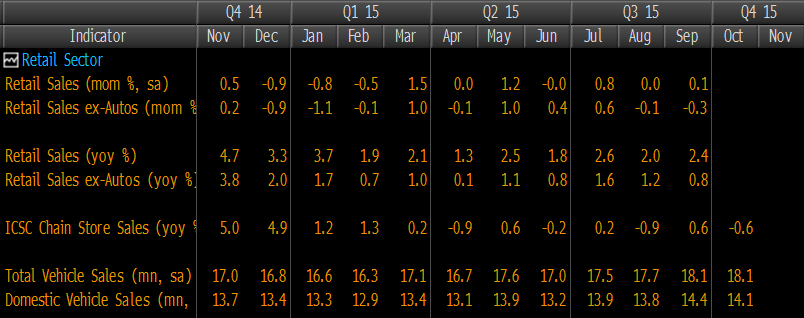

US retail indicators

Year on year sales aren't exactly looking strong ex-autos. The caveat to that is that auto sales remained strong in October so that should keep sales positive today. If that's the case that's going to make the details important and the control group, or core sales, is going to give us a better understanding of sales outside of big ticket items like cars and trucks. Sales there have flip flopped during the year but last month were up 3.4% y/y vs 2.8% in August

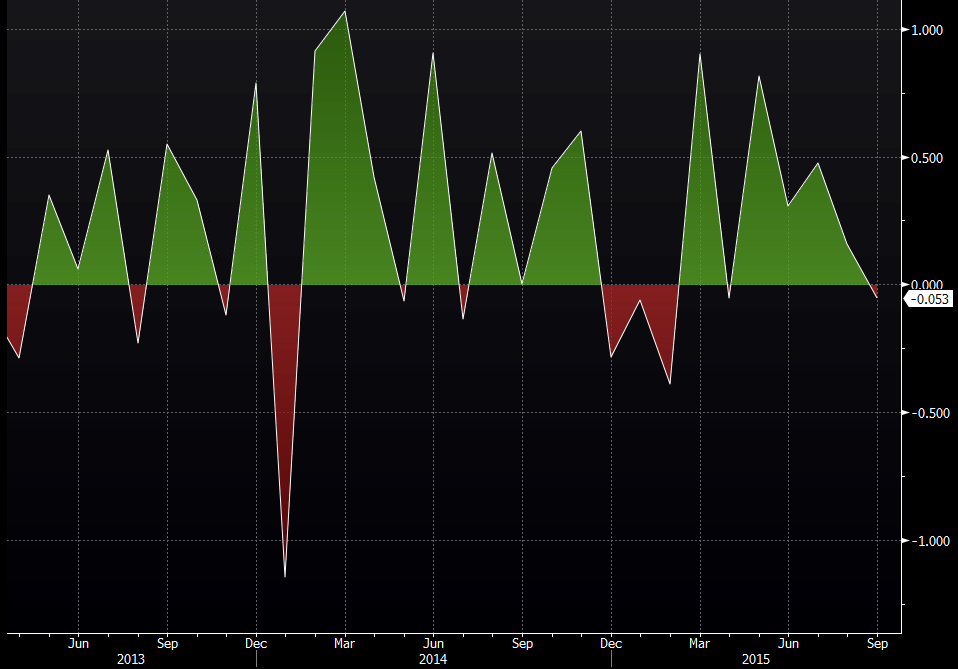

US core retail sales m/m

Given that we haven't seen great wages gains could keep retail sales on the back foot. That said, the fact that more people are finding work and thus gaining wages means that there is more money to be spent

Retail sales can be volatile and if we get a big variation then the dollar could overreact. Anything in the main number of control group that comes in near +/- 1.0% will see the greater move

It should also be noted that next month is one of the big holiday shopping months and the Census Bureau will be revising their sample model. They will be sampling around 4800 stores next month instead of the approximate 5000 they have been using so far. That might add some skew to what could be a volatile month anyway

Later on after retails we have the flash Michigan consumer sentiment. That's been pretty strong this year and is expected to rise to 91.5 from October's 90.0. The market moves on this one when it's in the mood. If we get good sales which are followed up by a decent number here that could keep some steam in any dollar rally going on at the time

PPI data is out at the same time as retail sales but unless there's any major shocks, the focus will be on sales

Lots to look forward too and hopefully lots of juicy moves to accompany it all. It all kicks off at 13.30 GMT