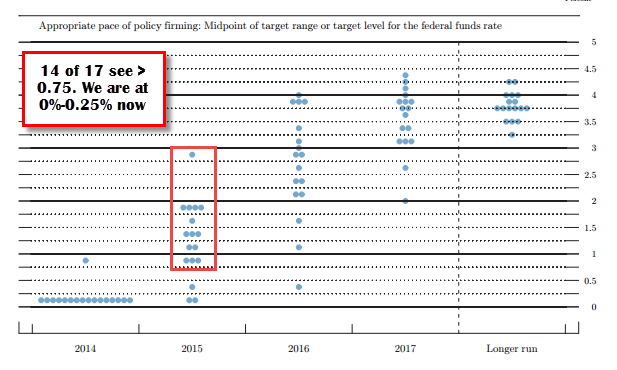

The Fed will meet next on December 16th/17th. At that time they are also expected to give their “central tendencies” of GDP, Employment, Inflation and on target Fed Funds rate at the end of 2015, 2016, 2017 and longer term. The last time they did it was at the September 16/17th meeting. The ‘dot chart’ of those projections are in the chart below. They do this survey every other meeting corresponding with the Fed Chair’s press conference.

The dot chart of Fed Member expectations for rates at the end of 2015.

Since the Fed only meets 8 times a year (not every month), back on September 17th 2014 when the “guesstimates” were made, I can imagine the end of December 2015 seemed far away for the Fed officials. With the date so far away, it may be easier to be brave and say “target Fed Fund rates will be x%”. Think about your own projections of currency rates. “I see the EURUSD at 1.10 in 2015 or I see the USDJPY at 130.00. We all have the courage of 1,000 matadors when giving our longer term projections. However, as time tics by, and the date becomes closer that vision becomes more clear and you realize, it “ain’t going to happen”.

So when you fast forward to December 17th, the end of December 2015 is not so far away – after all the change of the calendar year to 2015 is only two weeks away.

With that in mind, how does that make the 14 estimates of a Feds Funds Rate > 0.875 at the end of 2015 seem (see dot chart below)? Well, I guess getting above that hurdle is plausible if they start tightening mid year. How about the 9 estimates of > 1.375%? HMMM, that is > than 4 tightenings from the current level. If the first tighening is in the second half of 2015 (dealers expect a June 2015 start), that would imply a succession of tightenings into the end of the year. I am not so sure about that?

What about the 5 estimates of greater than 1.875%? Now the Fed better start tightening soon into 2015 and hope that Europe, Japan and China start to show some increasing signs of life as well in order for those estimates to come true.

So when Fed’s Mester says that “Fed forecasts could better communicate probabilities”, I think she speaks to the Fed’s painting themselves in the corner with their current way of communicating expectations/probabilities of rates. I personally agree with Adam Button when he correctly points out:

I think the Fed would be much better leaving markets to figure out the path of the economy and it’s inevitable that Fed forecasts will be wrong and used as fodder against it

In reality it is just too damn hard to figure out what may happen in this environment and there may also be a bias that paints a rosier picture than reality. So let the collective market decide, and stop the guessing of a few who tend to be wrong.