November 24, 2015

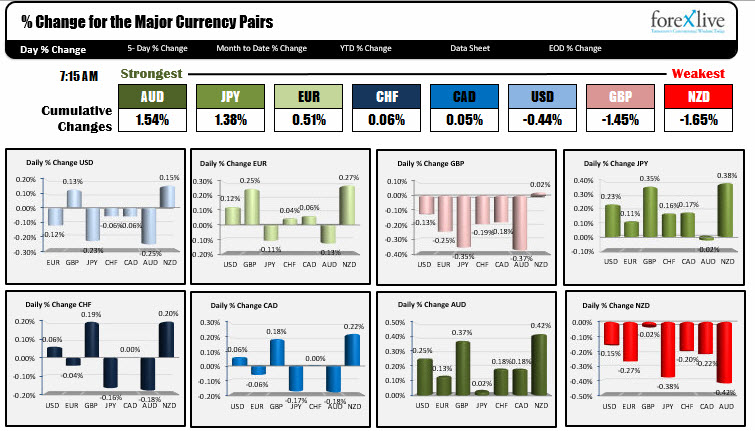

As NA traders arrive at their desks for the trading day, the AUD is the strongest currency while the NZD is the weakest. Sounds like the AUDNZD is on the run.

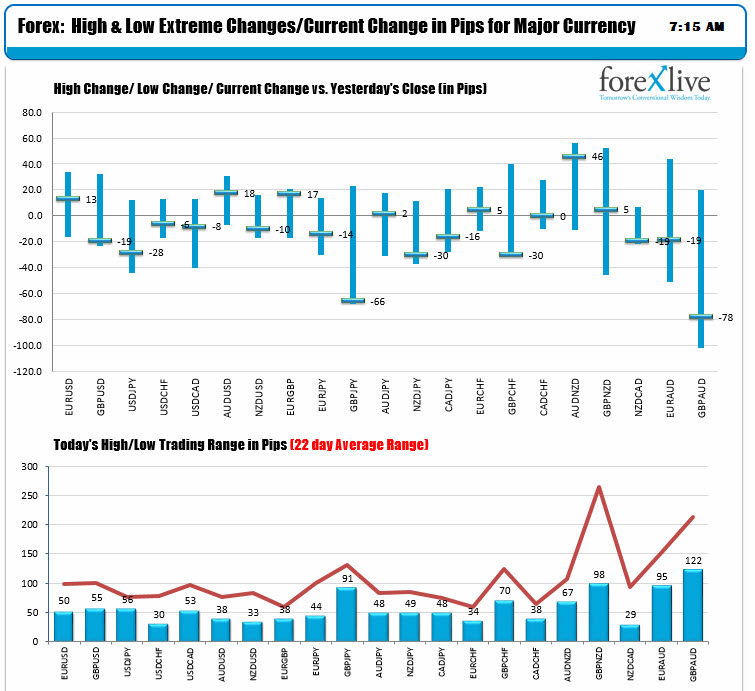

Note however, that the low to high trading ranges are not all that hot. All the pairs have ranges less than their 22-day MA range (red line in lower chart below). The AUDUSD range is only 38 pips for example and the AUDNZD is only 67 pips. Of the majors, the USDJPY is down 28 pips at the time of the snapshot and trading near the low levels as it tumbled below trend line support up at 122.83 in the Asia Pacific session

Today, German IFO Business Climate surprised to the upside. BOE Carney said "low interest rates will remain for some time". The GBPUSD is extending the downside (making new lows) as I type.

January oil prices are up 1.6%. European stocks are lower with the German Dax down 1.4% and UK FTSE down 1%. US stocks are forecast to open lower with the S&P futures down 15 points. Bond yields are lower in the US and Europe with US 10 year down 2bp to 2.20 and 10 year German bund down 3 BP to 0.498%. Gold is up +0.8%

ON TAP FOR TODAY: The US GDP (2nd cut for the 3Q) is expected to rise by 2.1% from 1.5%. There were times during the 3Q that trackers were looking toward 3Q GDP of <1% (Atlanta Fed GDP Now tracker had the estimate at +0.7% and had it's last estimate at 1.1%. HMMM. Consumption is expected to remain at 3.2%. S&P Case Schiller home prices are expected to increase by +0.3% for September and 5.10% YoY. US Consumer confidence is forecast to rise to 99.5 from 97.6 and the Richmond Fed Mfg Index is expected to move back positive to +1 from Octobers -1 reading