What's behind the dollar bid

For the second day, the US dollar has a strong bid against the flow of the risk trade. It even continues to make fresh highs against the Canadian dollar despite the breakout in oil prices.

Yesterday I tended to think the dollar rally was flow-driven due to the new month and that still might be the case but it could be something more.

I wrote about six reasons for a US dollar rally last month and the Dollar Index is now at the highest since December 1.

Let's revisit some of those themes:

1) US stimulus

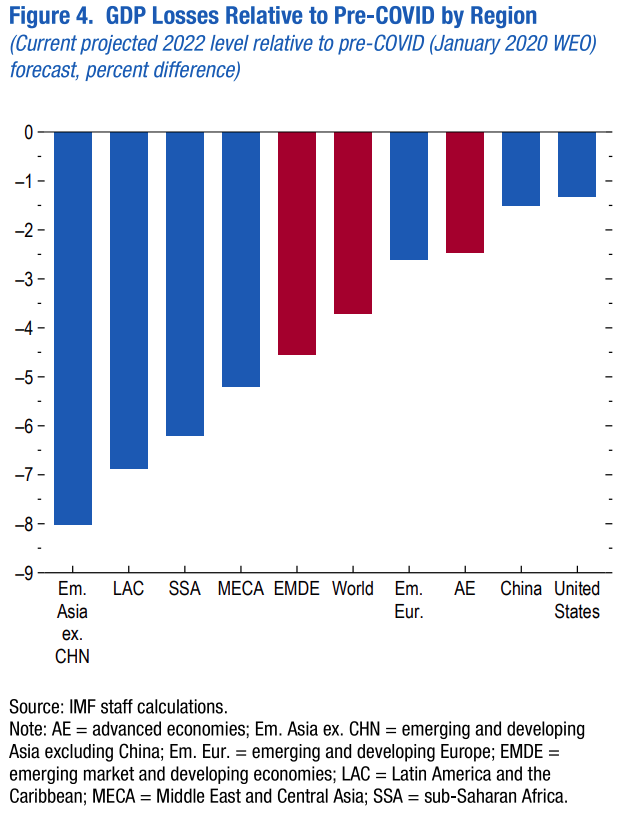

In all the meme stock madness, yesterday's positive news about US stimulus was drowned out. 10 Republican Senators are on board with $1000 checks as part of a $600B bill. There is some middle ground on spending and the old Tea Party obstruction doesn't look like it's in the playbook. With that talk, Treasury yields have climbed to 1.11%, which is also a dollar tailwind (though will below the 1.20% January high). The IMF also highlighted how the US growth cap is lower than anywhere in the world.

2) The US will be among the first countries to vaccinate

Yesterday the US vaccinated more people than the number of people who contracted the virus. Because it's the vulnerable who are being vaccinate first, hospitalizations have turned sharply lower.

3) Fed expectations are too dovish

The communication from the Fed hasn't changed but I continue to look at talk of 'no hikes until 2024' with skepticism.

4) Dollar positioning

Given the squeeze in meme stocks, there's a bit more focus on positioning an the dollar is heavily shorted. But this is FX, you can't squeeze shorts and move the market that way.

Why now?

That's a tougher question. There are some inflows into equities but there's no easy answer. Data this week has been thin and mostly soft anyway.