But that hasn't stopped the market from rallying

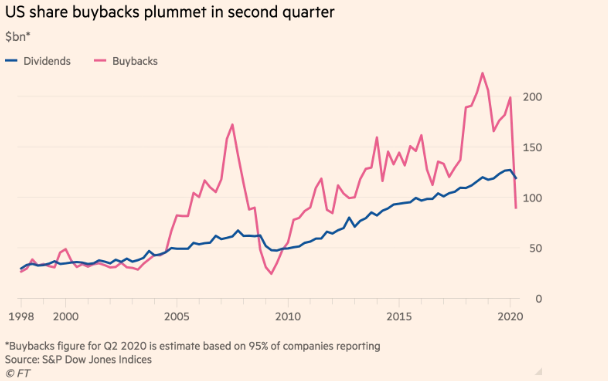

S&P Dow Jones Indices are showing that provisional figures on total spent on buybacks by companies in the S&P 500 was about $89.7 billion in Q2 2020 - down 46% from the same period last year.

The estimate marks the lowest quarterly total for buybacks by companies in the index since 2012 and the drop would have been much steeper without the aid of tech firms.

Unsurprisingly, the big banks were the notable ones absent from the list with Goldman Sachs, JP Morgan, Morgan Stanley and BofA all having said that they would stop buybacks in March as they contemplate larger provisions.

Meanwhile, the likes of Apple, T-Mobile, Alphabet and Microsoft contributed strongly to buybacks seen in the past quarter.

More on this from the FT here (may be gated).

An interesting point in all of this is what it tells us about the market rally over the past few months. This market has been resilient despite the lack of share buybacks for the most part. Q3 is also likely to be a muted period in terms of buyback activity.

Is the market really seeing light at the end of the tunnel amid the whole virus crisis? Or is cheap money really that powerful? What happens when buybacks start to come back into the picture and inflate valuations once again? Just some things to consider.