Comments from the State Dept

The US State Dept is on the wires with comments saying that an 'imminent' return to Vienna nuclear talks with Iran is needed. "This cannot go on indefinitely," they said.

Time is suddenly on Iran's side as the US looks for ways to ease energy costs.

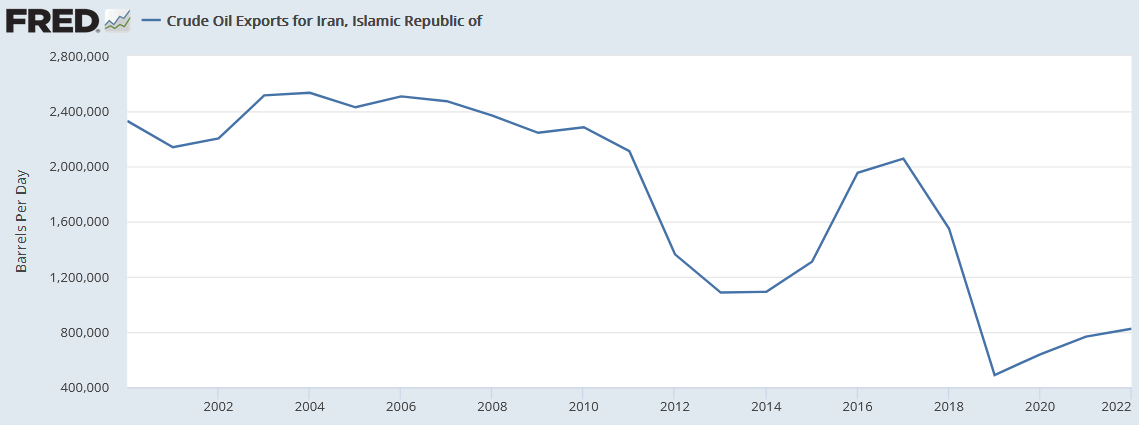

Official data shows Iran could add around 1.2 million barrels per day to global supply but it's much more complicated than that. For starters, they might already be pumping more than is showed as China and other countries accept Iran's oil covertly.

There's also the question of how much capacity is idle, how much of previous surges were draws on inventory and how quickly production will return.

Secondarily, OPEC has said it would compensate if Iran comes back but can you really trust them?

Overall, Iran returning would undoubtedly be a net negative for crude prices but it would also be one step closer to when all excess global oil capacity was absorbed. That's when longs would have nothing to fear and prices could really run if demand surprises to the upside, something that's certainly possible due to changes in post-pandemic driving habits.

Oil prices have been impressive today with WTI rebounding to $78.23 from a low of $74.97.