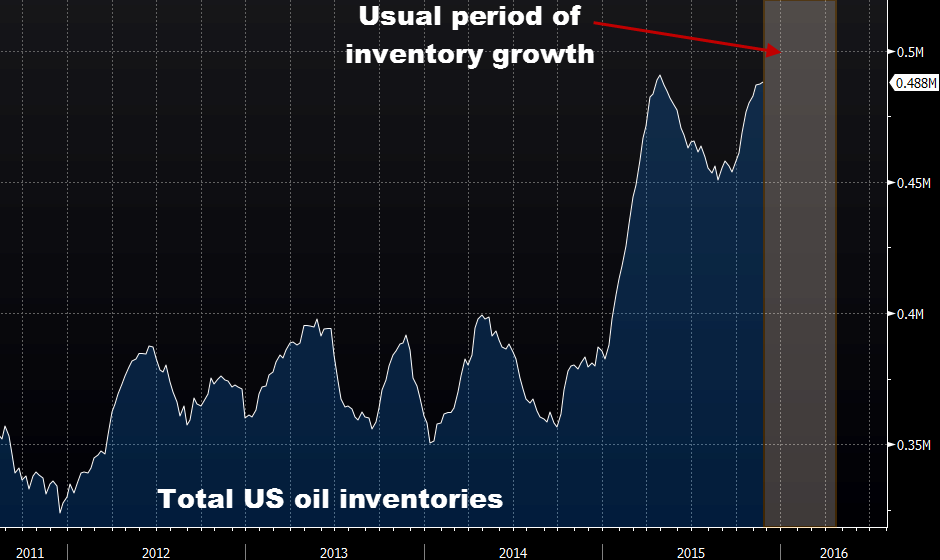

Weekly oil supply data from the Energy Information Administration:

- Prior was +252K

- API reported a +2600K reading

- Gasoline 2478K vs 950K expected

- Prior gasoline was +1009K

- Distillates +1046K vs -750K expected

- Refinery utilization +1.7% vs +0.4% exp

- US production down 17k bpd to 9.165 million barrels per day

The oil data looks like it's in-line but the market would have been looking for a larger build after yesterday's API data. So it's a bullish report for crude. That's balanced by the unexpected rises in gasoline and distillate inventories.

Overall, US production is up 1.0% y/y -- so much for a production bust. It just means that prices have to fall further before wells are shuttered.