US services and manufacturing surveys from Markit for June 2021

- Prior was 70.4

- Manufacturing 62.6 vs 61.5 expected (record high)

- Prior was 62.1

- Composite PMI 63.9 vs 68.7 prior

- Services input prices 74.6 vs 77.1 prior

- Manufacturing input prices 83.6 vs 78.1 prior

- "numerous panelists mentioned difficulties finding suitably trained candidates for current vacancies"

The US dollar has slid on this report. Services are still hot but are now off the boil after a miss here. It's still the second-best report on record.

Comments in the report from Markit chief economist Chris Williamson:

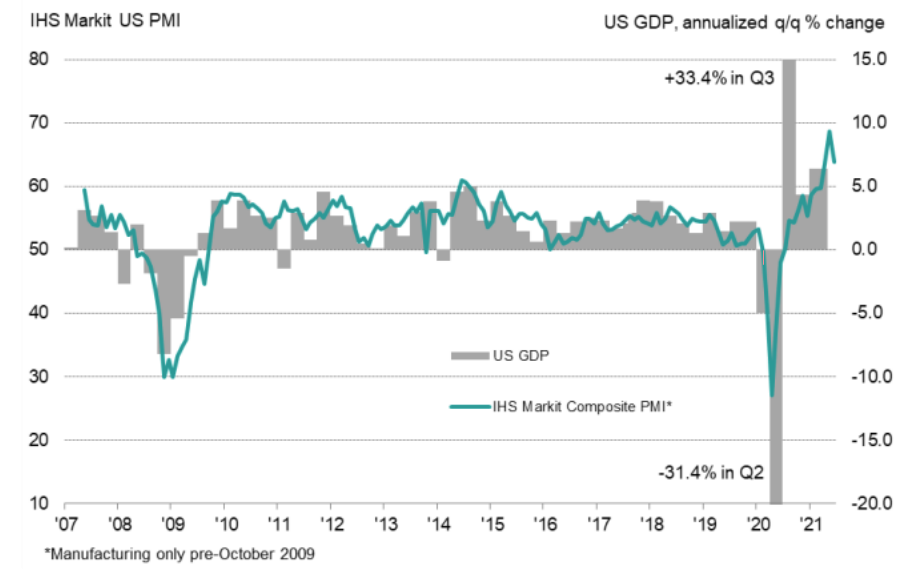

"The early PMI indicators point to further impressive growth of the US economy in June, rounding off an unprecedented growth spurt over the second quarter as a whole.

"While both output growth and inflows of new orders have come off their peaks in both manufacturing and services, this is as much due to capacity constraints limiting firms' abilities to cope with demand rather than any cooling of the economy.

"Although price gauges have also slipped from May's all-time highs, it's clear that the economy continues to run very hot. Prices charged for goods and services are still rising very sharply, record supply shortages are getting worse rather than better, firms are fighting to fill vacancies and manufacturers' warehouse stocks are being depleted at a worrying rate as firms struggle to meet demand.

"While the second quarter will likely represent a peaking in the pace of economic growth, a concomitant peaking of inflation is far less assured."