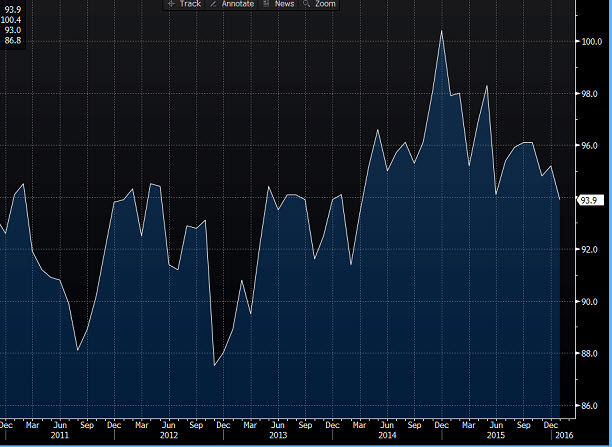

Data out a few moments ago

- 95.2 prev

Says the NFIB:

The overall Index dropped 1.3 points in January and now stands at 93.9, which is well below the 42-year average of 98. Last month the sharp increase of owners expecting their

real sales to improve did not materialize and this month it dropped by 4 points

to 3 %.

Owners expecting better business conditions in the next six months

dropped an additional 6 points after plunging 7 points last month, winding up at

a dismal net negative 21%. Actual spending and hiring numbers held up

pretty well and even though job creation fell, it maintained a respectable level

for this recovery. More owners reported cutting average prices than raising

them. Reports of higher compensation and hard-to-fill jobs rose to expansion

high levels."

A mixed bag but all to throw into the FOMC mix