The firm says that the yen may extend gains as demand for haven assets rise

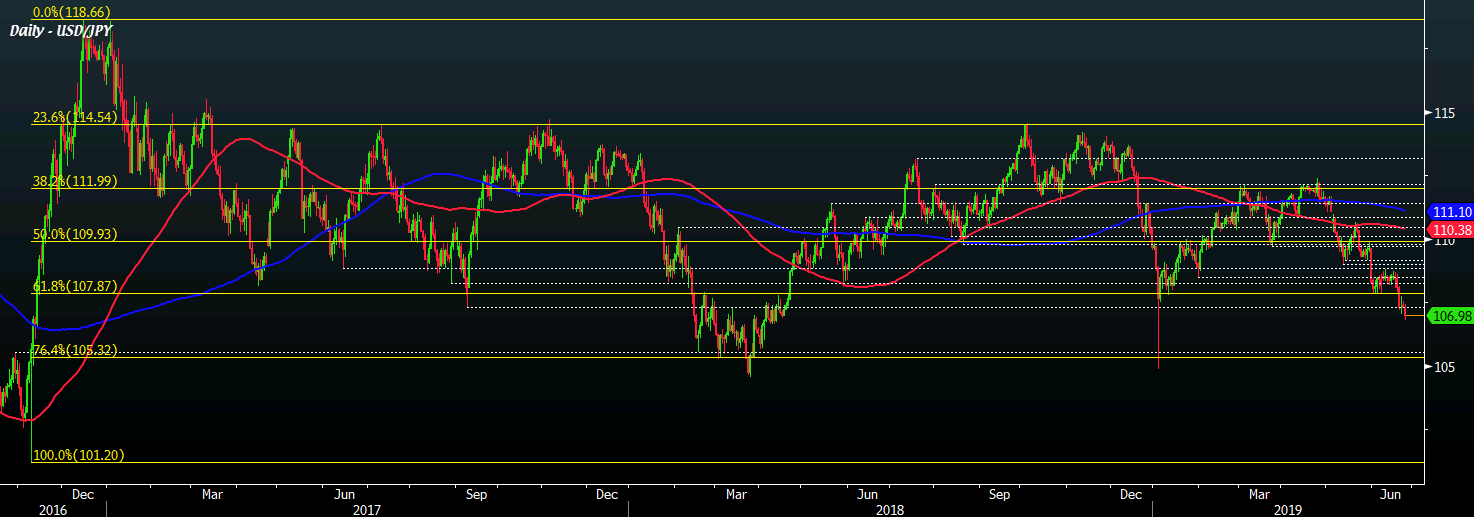

According to the firm's senior Asian FX strategist, Ken Cheung, they expect USD/JPY to extend its fall towards 104.00 amid dollar strength peaking out while haven demand will help to boost the yen's allure by the end of this year.

"We expect USD peaking out as rate cut cycle and heightening uncertainties over global recession risk and US-China trade war push safe havens like JPY higher. While the unwinding of long USD positioning before the Fed's rate cut cycle continued to weigh on the dollar, heightening safe haven demand on JPY given G20 uncertainties and increasing geopolitical tensions in Iran sent USD/JPY below the 107.00 handle."

A move towards 104.00 will see USD/JPY fall below the January flash crash low of 104.87 and would definitely bode ill for the BOJ in trying to maintain their goal towards hitting the ever-elusive 2% inflation target.