USO to move into more-distant contracts

The June contract fell as low as $6.50. The ETF held 30% of the open interest. If it goes negative then obviously the entire ETF is wiped out but that's not a big problem. The problem is that if it goes negative someone is holding the bag. You can't go after ETF holders for the money, and I doubt that the fund manager-- USCF -- is too keen on the risk of 136K contracts negative.

The problem is that announcing you're going to sell 30% of open interest is a disaster for prices and they're caught in it.

So what they're trying to do is to move to further out contracts without causing a disorderly selloff in the June contract. That's a tall task but they say they have put 5% of the fund in August futures.

What's terrifying here is that USO's NAV is around $1.50 and it was halted at $2.39. Retail traders are pumping money into it and have no idea what they're buying.

Update: So the fund managed to move 55% of its holdings into the July contract. That's an impressive switcheroo but even with that buying, the July contract is down $7.50 to $18.70. This is delaying the inevitable but with 40% in June and 5% in August, it's a moving target now.

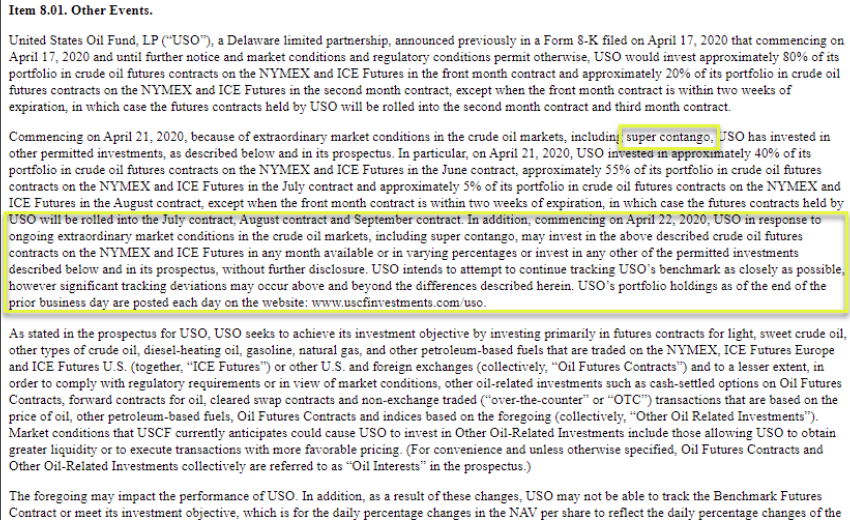

Update 2: Here's the statement. They're basically saying that they're running some kind of oil hedge fund now and they can invest in whatever they feel like. Where are the regulators?

It would have been nice if they included the current NAV.