Volumes start to dwindle as the Europe enters the summer period

The PMI's helped to tip EURUSD over with interbank seller being fingered for blame. Traders are noting that volumes are thinning now that the summer holidays are kicking in. My sprogs finished school Wednesday and by tonight the majority of the UK schools will have finished, and the exodus to the far corners of the globe (and Skegness) begins. I'm not sure when Speedo season begins in Europe but they can't be too far behind

EURUSD managed to pull up around 10 pips above the lows from yesterday

EURUSD 15m chart

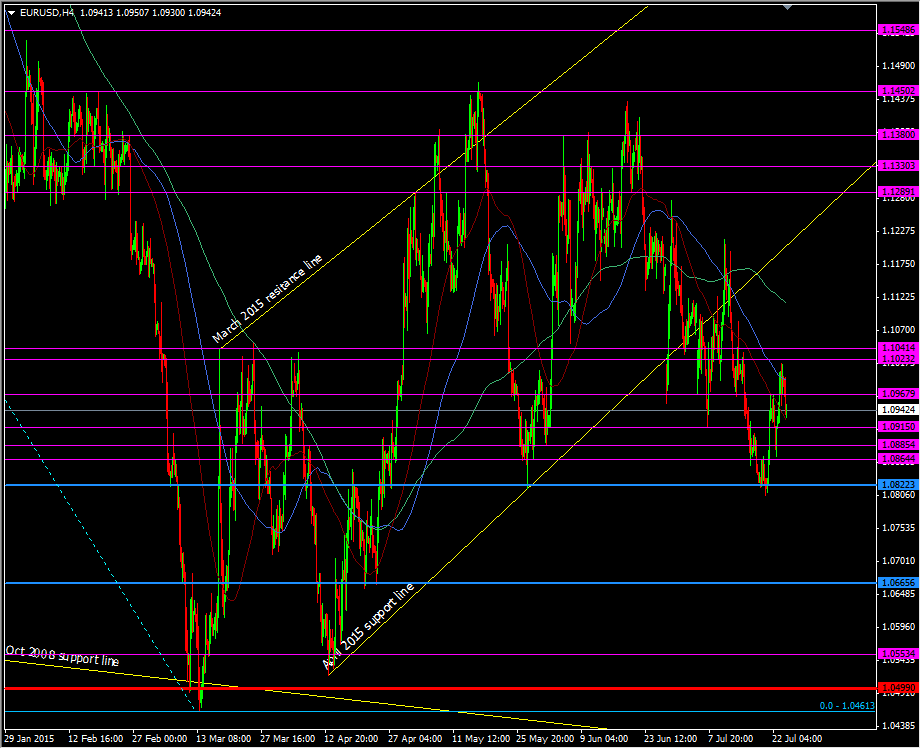

The 1.0920/30 level is shaping up to be decent intraday support. 1.0915 has also played a part technically and lower down the 1.0880, 1.0865 and 1.0820/25 levels are still worth noting

EURUSD H4 chart

We could well see a longer running range develop between 1.1000/40 and 1.0820/25, though we're not going to see volatility drop completely off the cliff. We still have the FOMC next week to keep us on our toes, and Greece will no doubt have a say too, plus there's plenty of economic data to add to the interest rate expectation picture. I'm hoping we don't have the same type of market we had last year as that will drive me bonkers

What we are likely to see is the periods between events dying off so look for ranges to develop and use the edges to play from. I'll also warn that as traders head off for their breaks we should expect the possibility of increased profit taking and position squaring between now and the end of the month

At the very least it gives me one last chance to use this picture before it goes into hibernation

It's just around the corner