Market participants reset odds for the September FOMC meeting

Fed fund futures now show that a 25 bps rate cut is 100% priced in with only 0.5% odds of a 50 bps rate cut. The former isn't changed but we're seeing a "reset" in the latter as the odds of a 50 bps rate cut were ~18% at the start of this week.

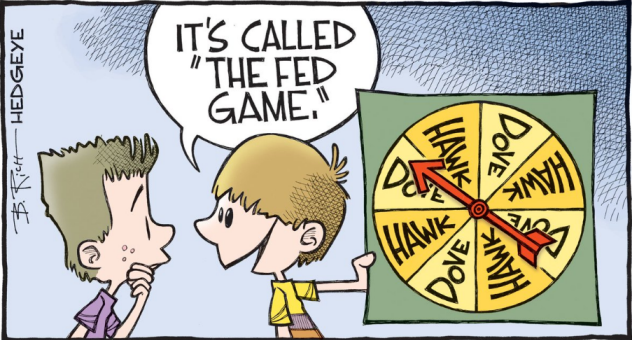

This shows that ahead of the Fed focus at Jackson Hole, markets are expecting the Fed to give some clues about whether they'll commit firmly to cut rates more aggressively in their coming meetings or not cut rates at all in September.

I reckon Fed chair Powell will play it safe in his speech later by reaffirming that there could be more rate cuts as part of the "mid-cycle adjustment" but possibly refusing to give anything away ahead of the September meeting.

If anything else, that could leave market expectations exactly where they are now but I reckon market participants may be a bit disappointed that Powell isn't going to be offering much more than that. As such, watch out for a potential "tantrum" in bonds.

Looking ahead, be on the look out for potential remarks by other Fed officials throughout the event. As seen from Esther George and Patrick Harker overnight, we may get more out of their comments than Powell this weekend.