Will ADP increase or lessen jitters over Friday's jobs report?

The ADP report was important last month as it gave the market a chance to trade on the following non-farm payrolls and ahead of the Easter holiday's. We all know how that turned out

Today's report could be equally important as it could allay any fears of a problem with the jobs market on Friday. Ordinarily the ADP is not an exact measure of the NFP's but if it has a wild swing then that gets the market moving in anticipation of the following jobs data

Looking at last month's report, we saw further gains for small business which took in 108k vs 94k in Feb. That was up from 78k in Jan, so a good trend is being seen there. Medium bus were stable at 62k vs 63k in Feb, though large bus only posted a 19k gain from 56k prior. As long as we're still seeing gains across the board there's nothing really to worry about as far as these employment numbers are concerned

For today, a gain of 200k is forecast after last month's 189k and the consensus range is 170k - 295k. Another print sub 200k could keep the dollar on the back foot. A number around expectations or over 210k will calm some dollar nerves. 220+ and the market will probably think that last months NFP was another weather induced one off and we'll be back on track with a well bid buck

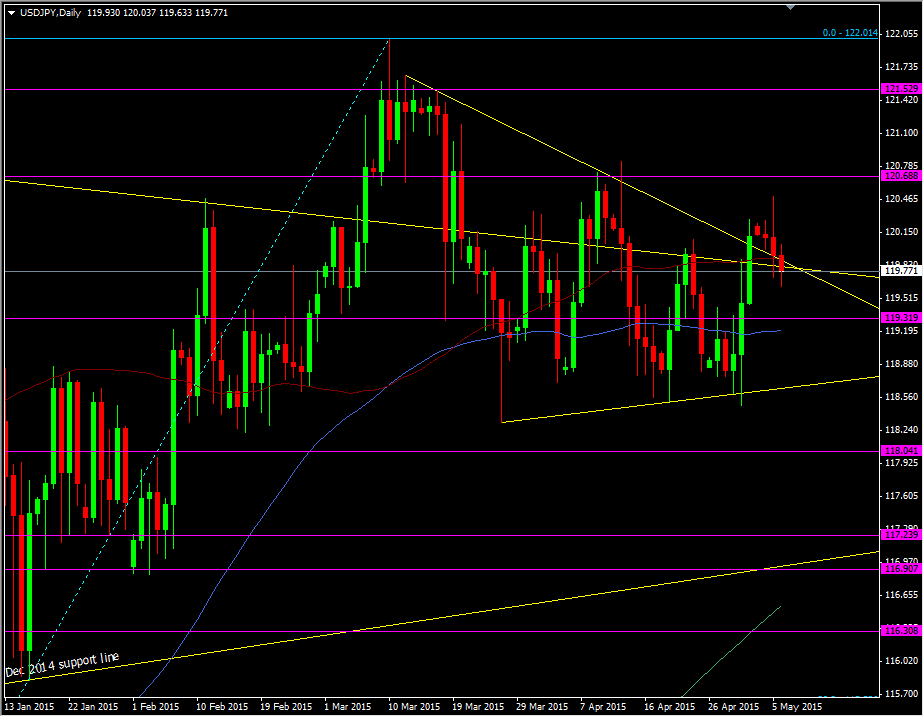

Looking at the prices, USDJPY is still finding it tough to break the upside with the 120.50 level holding resistance ahead of the stronger 120.65/70 level

USDJPY daily chart

Below, 119.45/50 still remains an area to watch for support as well at 119.30/35 and the 100 dma at 119.21

Those levels will probably serve you well to contain any outcome, barring something silly like a complete collapse or stupidly high print.

Following that the biggest event on the calendar is Aunty Janet meeting Christine Lagarde at the Institute for New Economic Thinking at 13.15 gmt There will be prepared remarks from Yellen followed by a one-on-one with Lagarde. The market will be looking for any clues as to the thoughts of the Fed following the last FOMC and poor GDP data, but we know that Yellen doesn't like to go out on a limb at these types of events. We can but hope that she drops a couple of good comments or remarks

The Little and Large show at 13.15 gmt