S&P Global / Judo Bank Final Manufacturing PMIs for Australia in July 2023 hits its highest since fbr at 49.6

- prior 48.2

The flash reading is here:

From the report, in brief:

- “All the main activity indicators rose in July with output and new orders both rising although still in contractionary territory at just below 50.

- “Employment has remained firm right through the slowdown in manufacturing activity.

- “Export orders rose slightly in July but remain below 50, where it has been since December 2022. A cyclical slowdown in global manufacturing activity is weighing on the Australian industry alongside the domestic backdrop.

- “The price indicators within the PMI survey suggest that input cost pressures picked up in July. The clear trend for weaker cost pressures over the past 18 months appears to have come to an end over the past 3-4 months.

- “A pickup in the July input price index likely reflects the combination of higher labour and energy costs, offset by lower commodity prices and material input costs.

- “The index of final prices continues to trend lower in 2023 consistent with a clear disinflation trend for consumer goods prices which was revealed in last week’s official inflation statistics for the June quarter.

--

The points made on price pressures gel with what I am seeing elsewhere - the easy inflation gains appear to have been made and CPI could prove much more sticky in the months ahead. Which will be a challenge for the RBA.

The Reserve Bank of Australia statement is due later today, latest previews are here:

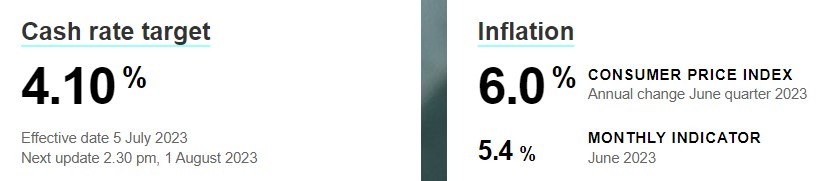

The latest cash and inflation rates from the RBA website.