Deutsche Bank now sees BOE hiking rates by 50 basis points in August and September. That previously forecasted a 25 basis point hike at each of the meetings through February 2023.

The BOE raise rates by 25 basis point day and said:

- Bank rate vote 9-0* vs 9-0 expected (Haskel, Mann Sauderes did vote for a larger 50 basis point hike instead)

- CPI inflation is expected to be over 9% during the next few months

- CPI inflation to rise to slightly above 11% in October

- BOE will take the actions necessary to return inflation to the 2% target sustainably in the medium-term

- The scale, pace and timing of any further rate hikes will reflect the assessment of the economic outlook and inflationary pressures

- BOE will be particularly alert to indications of more persistent inflationary pressures

- BOE will act forcefully in response, if necessary

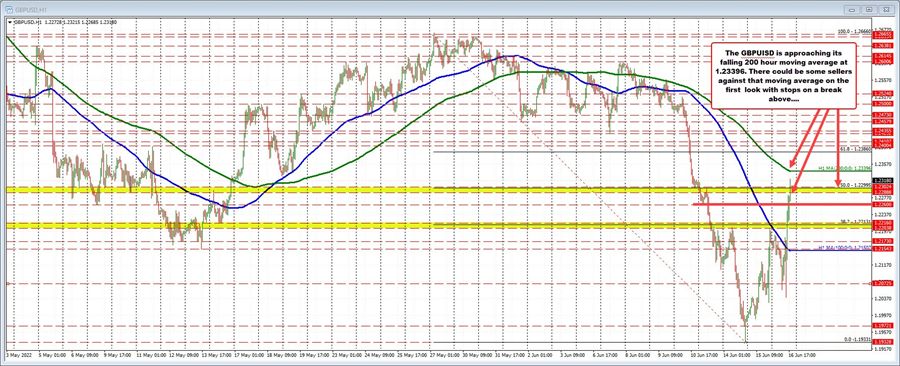

The GBPUSD is continuing its run to the upside reaching a new intraday high of 1.2322 as I type. The 200 hour moving average comes in at 1.23396. The price just moved above its 50% midpoint of the move down from the March 27 high at 1.22995. For traders looking for more upside momentum, close risk is now at 1.22888.

At the 200 hour moving average there should be sellers looking to take profit /sell against the key risk defining level. However, I would expect stops on a move above.

UPDATE: JPM is also seen 50 basis point increases in July and August.