Last week was a quiet one as it usually happens after the NFP. The focus was on the U.S. CPI as everyone wanted to know if inflation is cooling down. The data showed some relief year-over-year, but inflation remains high, so the fight is not over yet. The market now expects a 25 bps rate hike at the next FOMC meeting.

On Tuesday, we'll get the labour market data for the U.K and inflation data for Canada which can provide clues about future rate hikes. In the U.S. we'll have the empire state manufacturing index release.

The BoJ outlook report, monetary policy statement and the policy rate are expected Wednesday in Japan followed by the BoJ Press conference. Later that day, we'll get the U.S. PPI, retail sales and industrial production data.

In Australia the employment change and unemployment rate will be published Thursday; while in the U.S. the building permits and housing starts data is expected.

On Friday, SNB Chairman Jordan will speak in a panel discussion titled "What Next for Monetary Policy?" at the World Economic Forum. ECB President Lagarde is also scheduled to speak at Davos in a panel titled "Global Economic Outlook: Is this the End of an Era?". Some Fed members will also deliver their remarks this week.

In the U.K., expectations are for the unemployment rate to remain unchanged and the average weekly earnings to rise modestly from 6.1% to 6.3%. In Canada, inflation data showed some signs of cooling down in the last few months. The year-over-year CPI is likely to fall from 6.8% to 6.5% due to energy prices softening.

At the next meeting, the BoC is likely to hike the rate by 25bps to a terminal rate of 4.50%.

According to analysts from Wells Fargo this could be the last rate hike from the BoC if core inflation will decrease noticeably in the coming months. However, SGH Macro analysts don't expect the tightening to stop until price stability is achieved.

Since the effects of monetary policy changes usually lag, there is a possibility that the BoC will pause after the next meeting in order to observe how things evolve. Governor Macklem warned that hiking rates excessively could push the economy into an "unnecessarily painful recession."

The U.S. retail sales and industrial production prints will be important to watch. Even though retail sales fell in November, consumer spending remained strong. The most affected categories were furniture and auto sales, as they are primarily funded by credit. It is possible that retail sales will stabilize as consumer spending appears to remain strong due to labour market tightness. For industrial production though the overall picture doesn't look optimistic as the declining trend is expected to continue. The ISM Manufacturing Index is likely to contract further.

The BOJ surprised the market last month when it tweaked its bond yield controls, to allow a wider tolerance for long-term interest rates for its 10-year bonds, something investors didn't expect. It is rumoured that there will be a change in monetary policy from the BoJ at some point, but it's unlikely to happen until April when Governor Haruhiko Kuroda's mandate ends according to some analysts, but surprises can always happen.

The U.S. housing starts and existing home sales are expected to be under pressure again with demand falling due to higher mortgage rates.

In Australia, the labour market data will be important for the RBA's future decisions following high inflation numbers in November. If there's no slowing the Bank might be forced to hike more than the 50bps that are currently forecasted by analysts from ING.

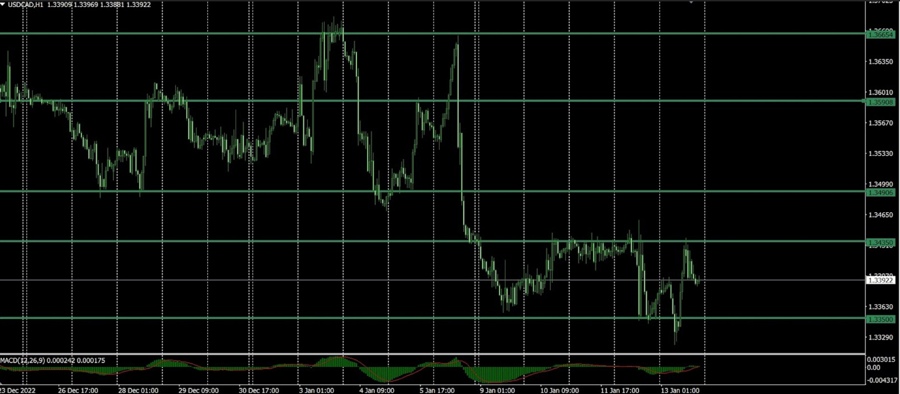

USD/CAD expectations

With lots of data to digest this week for both the U.S. and Canada trading the pair this week might be difficult as it lacks a clear direction on the H1 chart.

However, a bullish divergence seems to be forming on the H4 chart which might suggest a bigger correction for the pair until the 1.3490 or even 1.3590 levels of resistance. From there the bearish trend should resume taking into consideration that the market now expects rate cuts and the USD to lose strength in the near future.

On the downside the next levels of support are at 1.3350 and 1.3260.

A risk for this trade are the CPI data for Canada and industrial production for the U.S. which should be closely watched.

This article was written by Gina Constantin.