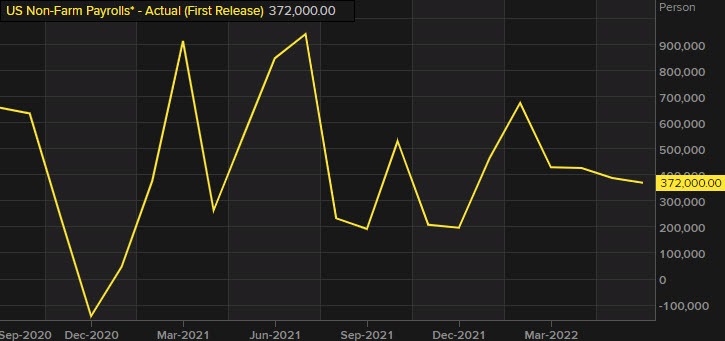

The Fed stressed on data dependency and Powell outlined that they will have two labour market reports and two consumer inflation reports to get through before the September meeting, so we're now at the first hurdle. The consensus for the non-farm payrolls figure today is +250K.

The headline figure will obviously attract first attention in markets and any major miss or beat will lead to some kneejerk reactions. But the details will once again be key with a look towards the unemployment rate and wages.

So, what exactly are markets looking for at this point?

Any signs of weakness in the labour market is perhaps the main thing to be wary about. We're at the stage where bad news is good news and if there are credible signs for the Fed to pull back on being more aggressive, it is going to be bedlam for risk trades.

At some point, growing recession risks will hit at confidence - especially if a 'hard landing' looms large - but for now, central banks are dominating the narrative and we're in the second-half of the tightening cycle already. That is evident by the Fed's subtle shift last week, in which we also saw the RBA and BOE do with their "policy is not on a pre-set course" this week.