The Fed made a hard pivot on inflation this summer with the plan to get it under control over roughly 18 months.

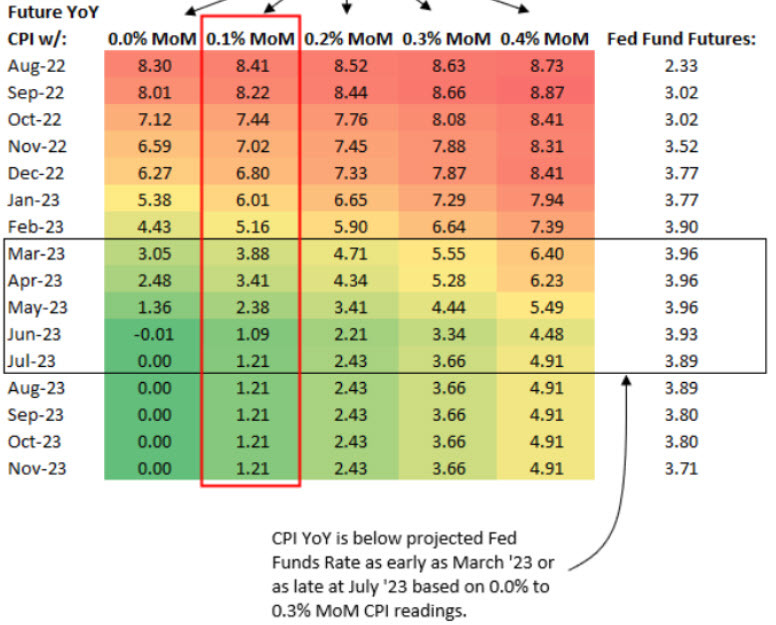

This is a good 'scorecard' to measure where inflation will be. It's from Bespoke.

Each month a reading of +0.2% roughly equates to 2-3% inflation, so that's 'par'. Birdies are +0.1% and bogeys are +0.3%. The past two months have been 0% (an eagle!) and +0.1% but those came with some big help from tumbling gasoline prices.

The good news is that some other items will begin helping inflation as well, like cars and household furnishings. There are also much easier comps coming year-over-year because of high commodities in Q42021/Q12022.

Goldman Sachs says today that they expect sharp declines in both core and headline CPI by the end of the year. They see core falling roughly to 'par' at 2.7% in Dec 2023 and headline at 2.5%.

For markets and the Fed, they're going to need to see a string of several months of 'par' or better to believe in a win against inflation.