The US 10 year has just moved to a another new cycle high. The yield is now at 3.483%, that's up 11.3 basis points on the day or 3.36%. The rate has moved up from 2.71% on May 27, to the high yield today of 3.48%. That's a move of 77 basis points over 12 trading days.

The move higher in rates has also sent mortgage rates sharply to the upside. The 30 year mortgage rate is up 15 basis points to 6.28% or 2.45%.

With regard to the Fed Funds outlook, the market is now pricing in a terminal rate over 4% by May 2023.

Looking at Fed funds pricing through the year end, the market concensus now sees two 75 basis point hikes in June and July, 50 basis points in September and November and 25 basis points in December for a gain of 2.75% from the current rate of 1.00%.

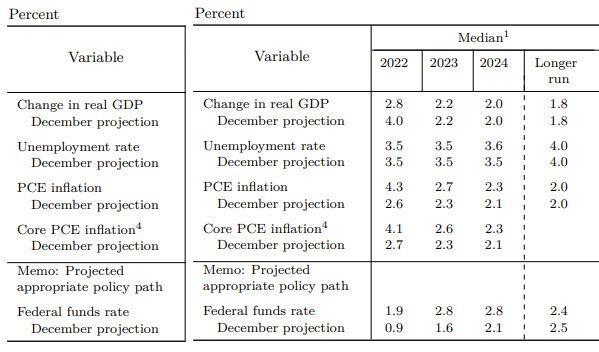

Tomorrow the Federal Reserve is expected to raise rates by 75 basis points up from 50 basis points just yesterday (I am sure it has been leaked by Chair Powell). The decision will be made at 2 PM ET with the press conference at 2:30 PM ET. The Fed will also release the latest dot plot as well as central tendencies for GDP, employment and inflation.

The central tendency in March showed the following:

In 2022, I personally would tilt down the GDP, tilt up the unemployment rate, increase significantly the inflation projections, and increase the Fed funds rate by the end of December significantly. In 2023, it's anyone's guess, but if the Fed is going to go "all in" as far as rate hikes in 2022 and into early 2023, the hope is that inflation DOES start to come down (but would come at the expense of growth).

The wildcards are the shocks from Ukraine war, Covid in China, and the potential for increased tension from China in Taiwan..