The US dollar is at the best levels of the day after the ISM services report beat estimates, casting doubt on the recession talk. The July reading was 56.7 compared to 53.5 expected, boosting hopes that spending is making a smooth shift to services from manufacturing. Moreover, the measure of prices paid decelerated to 72.3 from 80.1. That's still very high but is moving in the right direction.

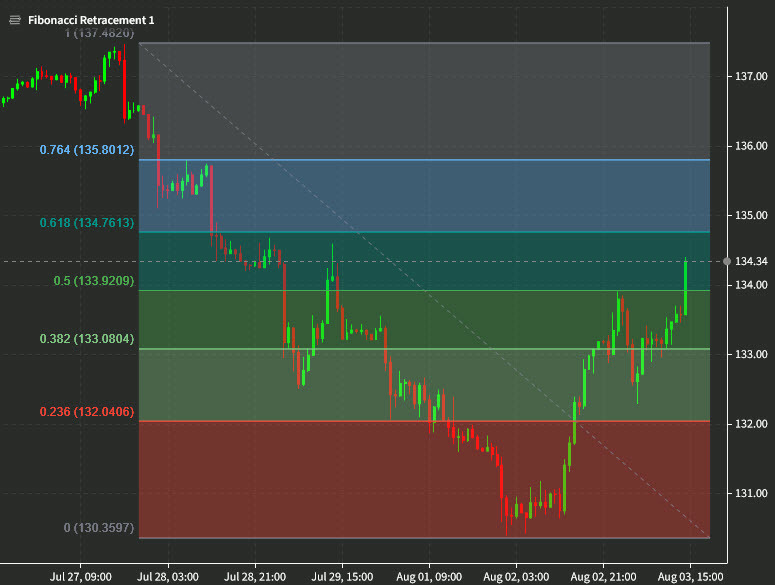

The dollar cheered the strong economic news with USD/JPY leading the way for the second day. The pair added about 60 pips to gains and is now up 117 pips to 134.35. It's now within striking range of the 61.8% retracement of the four-day fall from July 27 to Aug 2.

The dollar move also extends to EUR/USD and that pair is now at the lows of the day, down 22 pips to 1.0141. The late-July low was 1.0097.

Adding support to the move are bonds. US 10-year yields reversed strongly yesterday and are up another 10.6 bps to 2.84% today. They had fallen as low as 2.51% yesterday.

We are set for more Fedspeak at the bottom of the hour with Harker to speak. That will be followed by Barkin and Kashkari later. Expect them to continue to push back against dwindling rate hike expectations. So far that's worked and the market now sees Feb Fed funds at 3.52%, up about 15 bps this week.