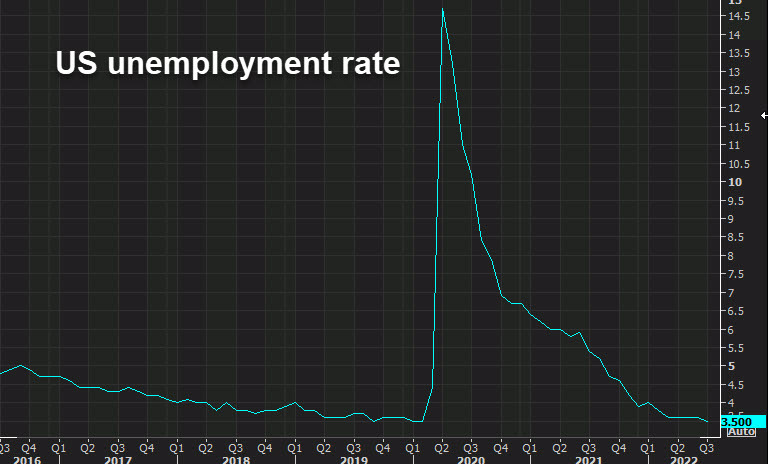

The US dollar made a big jump after the July non-farm payrolls report showed the economy adding another 528,000 jobs, far more than the 250,000 consensus estimate of economists. In addition, the unemployment rate fell to 3.5% from 3.6% and matches the pre-pandemic low.

The strong jobs data pushed back on the idea that the economy is in recession but it boosts the idea that it's overheating and will require more rate hikes to cool it off. The odds of a 75 bps hike at the September Fed meeting rose to 67% from 40% on the release.

Bond yields jumped with 2s up 17 bps to 3.21% while 10-years rose 12 bps to 2.80%.

That's a perfect storm for the US dollar as it soared across the board. USD/JPY rose to 134.40 from 133.17 before the release. That wipes out this week's declines and pushes the pair to the top of the August range.

The euro fell to 1.0176 from 1.0230 and cable to 1.2082 from 1.2145.

Adding to the case for dollar strength was strong wage data. Average hourly earnings rose 0.5% in the month compared to 0.3% expected.

Canadian jobs data were released at the same time and disappointed at -30.6K compared to +20.0K expected. USD/CAD rose to 1.2928 from 1.2885.