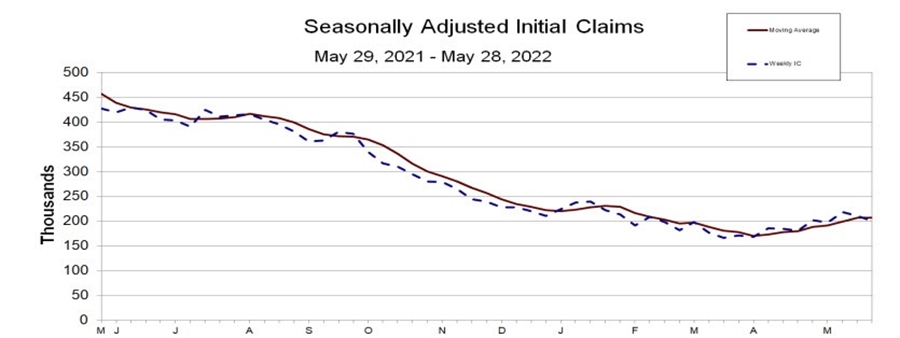

- Prior report, 210K revised to 211K

- Initial jobless claims 200K vs. 210K estimate

- 4 week moving average of initial jobless claims. 206.5K vs. 207K last week

- Continuing claims 1.309M vs. 1.325M estimate. Last week revised to 1.343M vs. 1.346M previously reported. This is the lowest level since December 27, 1969 when continuing claims were at 1.304M

- 4 week moving average of continuing claims 1.327K vs. 1.347M last week. This is the lowest average since January 10, 1971 the average came in at 1.310M

With employment strong, the continuing claims continue to trend to the downside and reached new lows now going back to 1969. That should be good for the deficit, but shows the continued strength in the jobs market.

Looking at the stock market , the Dow is currently up 108 points. The NASDAQ is up 54 points. That is lower than the premarket levels seen earlier in the US session.

The markets are pricing in a 97% chance of a 50 basis point hike in June and a 95% chance of a 50 basis point hike in July.

For September, the expectations is up to 67% for a 50 basis point hike. That is up from a level near 30% was reached last week after Bostic's comments that the Fed may take a breather in September. He has since walked back that comment.