- Manufacturing 46.8 vs 46.0 expected

- Prior was 46.2

- Services PMI 46.6 vs 45.0 expected

- Prior services 44.7

- Composite 46.6 vs 44.6 prior

- New orders declined, led by manufacturing

- Cost burdens increased for the first time in eight months

- Backlogs of work fell

- Business optimism hit a four-month high

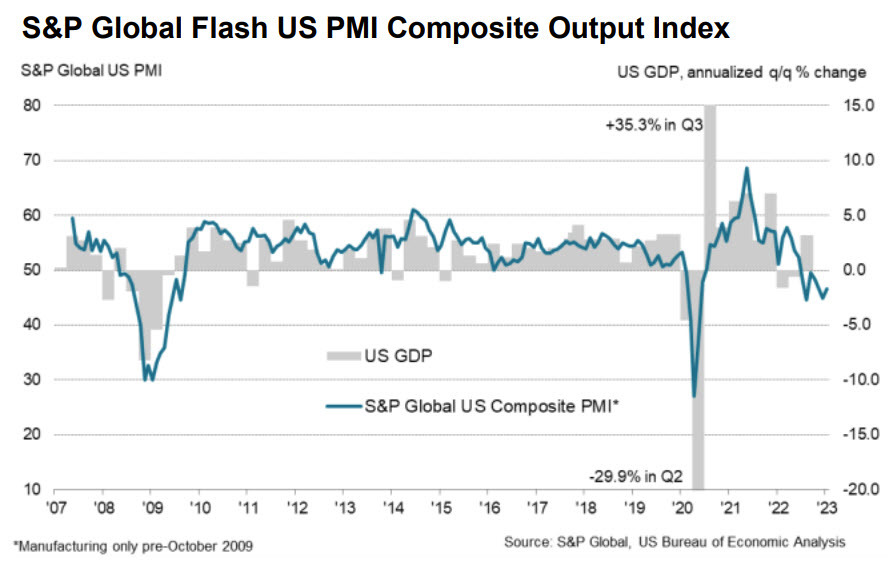

This is a better reading but below 50 still points to a contraction.

Commenting on the US flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The US economy has started 2023 on a disappointingly soft note, with business activity contracting sharply again in January. Although moderating compared to December, the rate of decline is among the steepest seen since the global financial crisis, reflecting falling activity across both manufacturing and services.

“Jobs growth has also cooled, with January seeing a far weaker increase in payroll numbers than evident throughout much of last year, reflecting a hesitancy to expand capacity in the face of uncertain trading conditions in the months ahead. Although the survey saw a moderation in the rate of order book losses and an encouraging upturn in business sentiment, the overall level of confidence remains subdued by historical standards. Companies cite concerns over the ongoing impact of high prices and rising interest rates, as well as lingering worries over supply and labor shortages.

“The worry is that, not only has the survey indicated a downturn in economic activity at the start of the year, but the rate of input cost inflation has accelerated into the new year, linked in part to upward wage pressures, which could encourage a further aggressive tightening of Fed policy despite rising recession risks.”