WTI crude nears $40 per barrel, what's next

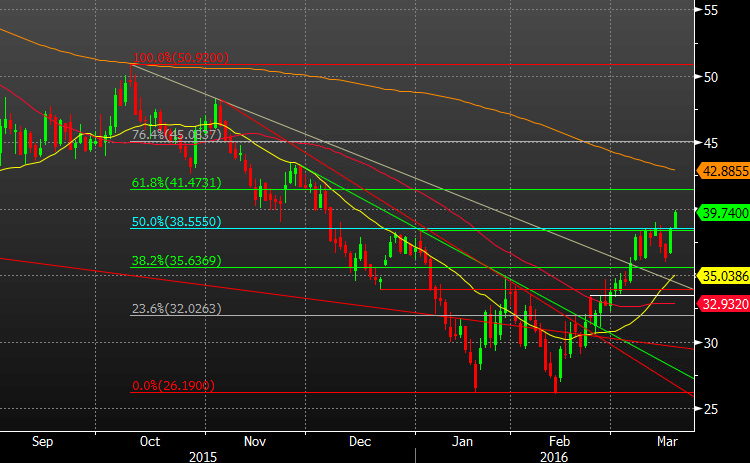

In the past 10 days, oil had flattened out at the confluence of resistance near $38.50 but the dovish Fed reignited the upside and it has broken out.

At the beginning of he month, I warned that March was the strongest month for crude and that has proven true so far.

The immediate target of the move is the 61.8% retracement at $41.47 and that's followed by the 200-day moving average at $42.88. Then, there is a confluence of resistance around $43.50.

To me, the $41.47 level is the most important one. Fundamentally, OPEC is floating around with talk about a production freeze on April 17. Ofcourse, it's nonsense and the only 'freeze' anyone will announce is what was already planned or due low oil prices. In any case, he headline risk from the meeting might keep the oil bears at bay for another month, at that might be enough to spark a rally all the way to $50.