Yen pairs take a slap round the chops after the BOJ stirs things up

Anyone can be a hindsight billionaire but trading hindsight is worthless. The same can be said for analysing news headlines a while after they hit. When something hits the screens you've got seconds to analyse it, call it and trade it. Even so, 999 times out of 1000 you'd still be lightyears behind the news algos

USDJPY jumped to 123.56 because everyone read the headlines the same way when they hit. Markets are tough enough as it is, at this time of year and to have these big events thrown in too just makes it more of a mess

So now we're 250 pips worse off and back in the midst of the year end flows

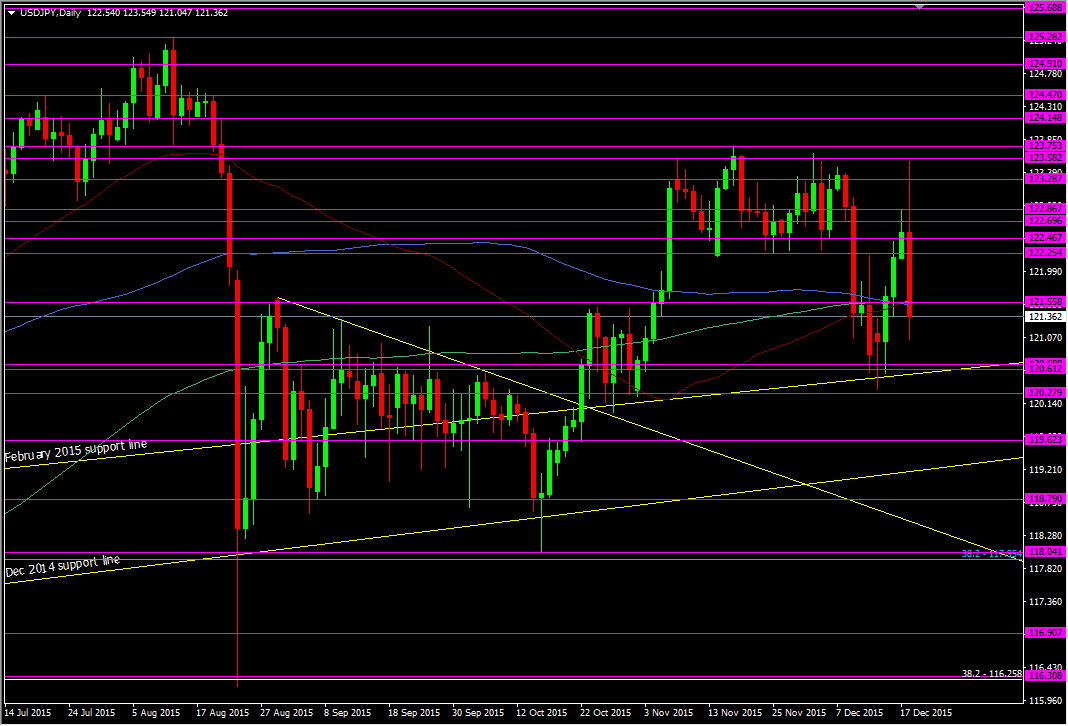

If I could were to have picked a spot to see support come in it would have been at the confluence of the dma's which are clustered around the 121.50/60 area. From such a drop it would have been the logical spot

USDJPY daily chart

While they may not have held up the drop they may certainly stem any return. As I type we seem to be struggling around the 121.40 level

There's next to nothing on the US calendar except for US services PMI and the Fed's Jeffrey Lacker at 18.00 GMT. He'll be the first scheduled speaker after the FOMC so will probably add some insight to the Fed's decision to hike

Going forward, if we hold below the dma's then we could see the price ping pong between here and the low at 121.00, where the support is strong enough to stop the drop

While future expectations for the BOJ may have diminished further today, the Fed trade is still far from over just yet so be prepared for some retrace. I was long from 121.00 into the Fed and if we get another test and hold I'm going to add to that. I'll be looking to get out well before the holidays next week