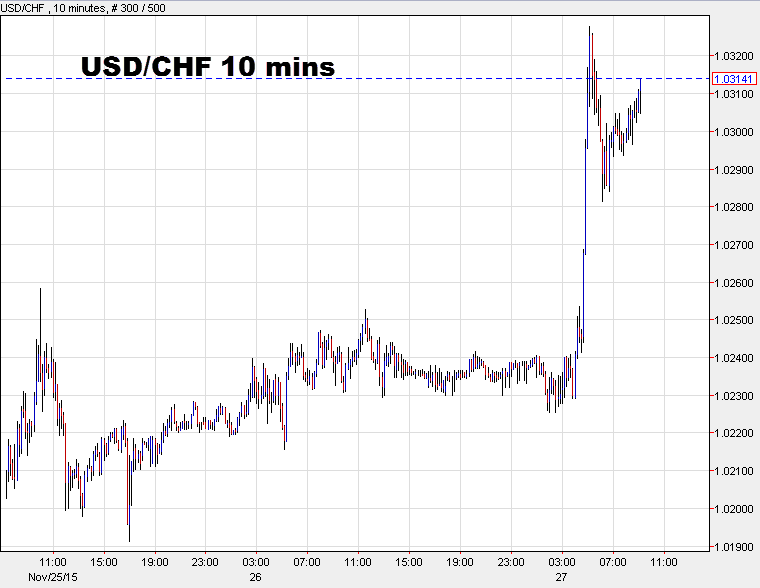

Biggest drop in the franc since Nov 3

I think we all expected a bit more quiet with most of the US off for holiday today but it's turning into bustling day.

The five main themes are:

- The drop in Chinese stocks (-5.8%)

- The drop in gold

- The drop in the Swiss franc

- General USD strength

- Oil weakness

If you're looking for an easy explanation on any of them, it's not to be found. On China, a crackdown on some brokers and weak industrial profits data is the best we've got to go on.

For the Swiss franc, there's even less. The SNB has been quiet as USD/CHF rises to the highest since Aug 2010.

Many are pointing to the SNB because today is 6 days before the ECB meeting. The great peg-pull of Jan 2015 was 7 days before the ECB first announced QE. The SNB was proactive before, so why not again.

The other side of the argument is that it was simply a wave of technical buying after 1.0240 broke. That was the high before the dam burst and stops were seemingly run as it broke in a quick rally as high as 1.0328.

The problem is that 1.0240 also broke earlier this week and it didn't provoke that kind of selling. Maybe the stops were above 1.0260?

Bloomberg has more on the franc but nothing particularly insightful.