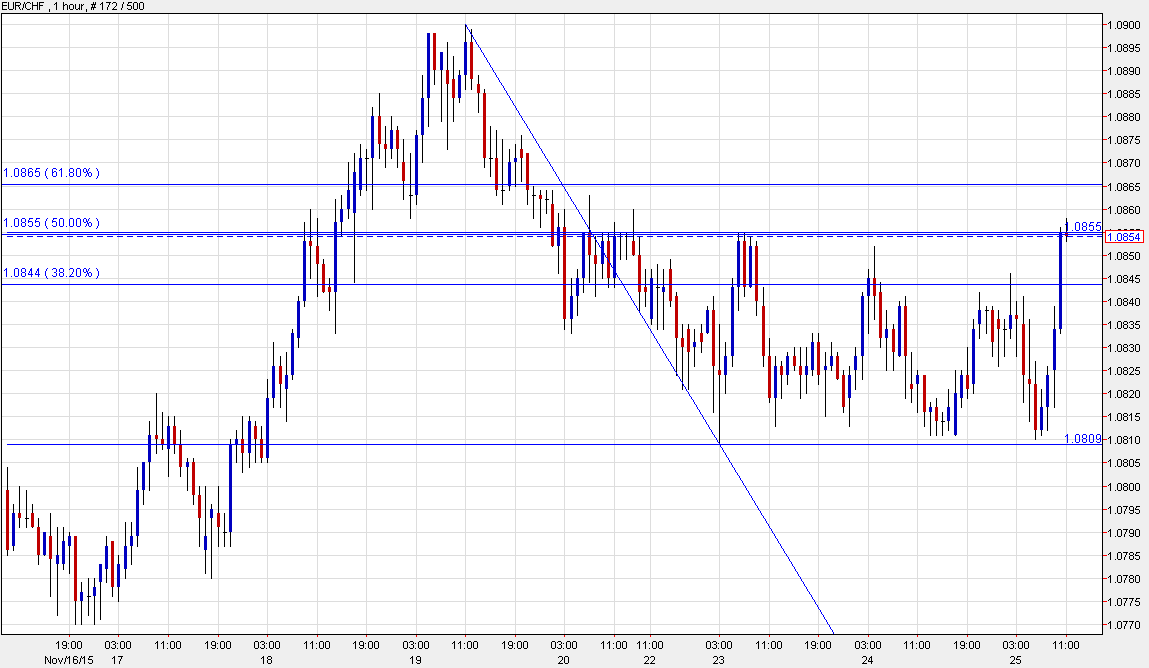

Support ahead of 1.0809 holds

EUR/CHF is showing some resilience in November. There is a series of higher lows on the daily chart and now a dip down to 1.08 early this week has proved to be a minor springboard.

The 45 pip rally over the past few hours underscores demand (central bank or otherwise) at opportune levels and the ability to rally above the Mon and Tues highs along with the 50% retracement is a signal of strength.

What's likely driving it is the Swiss bond market. 10-year note yields there just touched a record low at -0.382%. Who the heck is buying that?

There are a few hurdles to the upside, including the 61.8% band at 1.0865 along with 1.09 but I think a return to the 1.10+ zone is possible if the ECB doesn't deliver a big cut in the deposit rate and a significant increase in QE.

The SNB may be proving that the deposit rate is the key factor but in a banking/money laundering/tax evasion hub like Switzerland, the banking sector is more important that in broader Europe.