German Dax -1.5%. UK FTSE -1.15%.

The major European stock in season ending the day with sharp losses. The provisional closes are showing:

- German DAX, -1.54%

- France's CAC, -1.70%

- UK's FTSE, -1.15%

- Spain's Ibex, -1.2%

- Italy's FTSE MIB, -1.24%

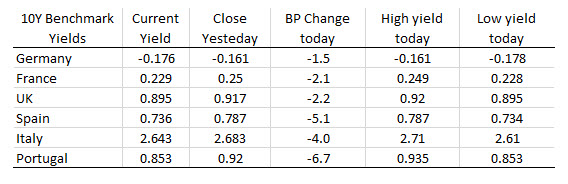

In the benchmark 10 year note sector, yields have continued their trend lower with the larger declines in the more "risky" countries ( Spain Italy Portugal).

In other markets, as traders in London/Europe look toward the exits:

- Spot gold is trading at $3.28 or 0.25% at $1282.61

- WTI crude oil futures are getting smashed at $-2.04 or -3.42% at $57.11. The oil complexes getting hurt on expectations for weaker global demand

In the US stock market, major indices are trading near session lows. The S&P index and the NASDAQ index are also trading below their 200 day moving averages:

- S&P index -31.7 points or -1.15% at 2770.40. 200 day moving averages at 2776.08

- NASDAQ index -89.6 points or -1.18% at 7517.80. 200 day MA is at 7527.09

- The Dow industrial average as trading down 3-320 points or -1.26% at 25052

In the US debt market yields are sharply lower, as risk off flows send investors flocking to the US treasury market. The two-year yields are down -6.4 basis points. The 10 year yield is down -5.3 basis points

IN the forex market, the CHF remains the strongest and the NZD remains the weakest. The USD is finding more of a bid with EURUSD, GBPUSD, USDCAD, AUDUSD, and NZDUSD all reaching new extremes the last hour (trading at USD high levels).