The pair is doing it's A-B-C's before ECB decision tomorrow.

The EURUSD has moved lower to new session lows for the day in the NY session, as the pair continues to back fill before the key ECB decision tomorrow.

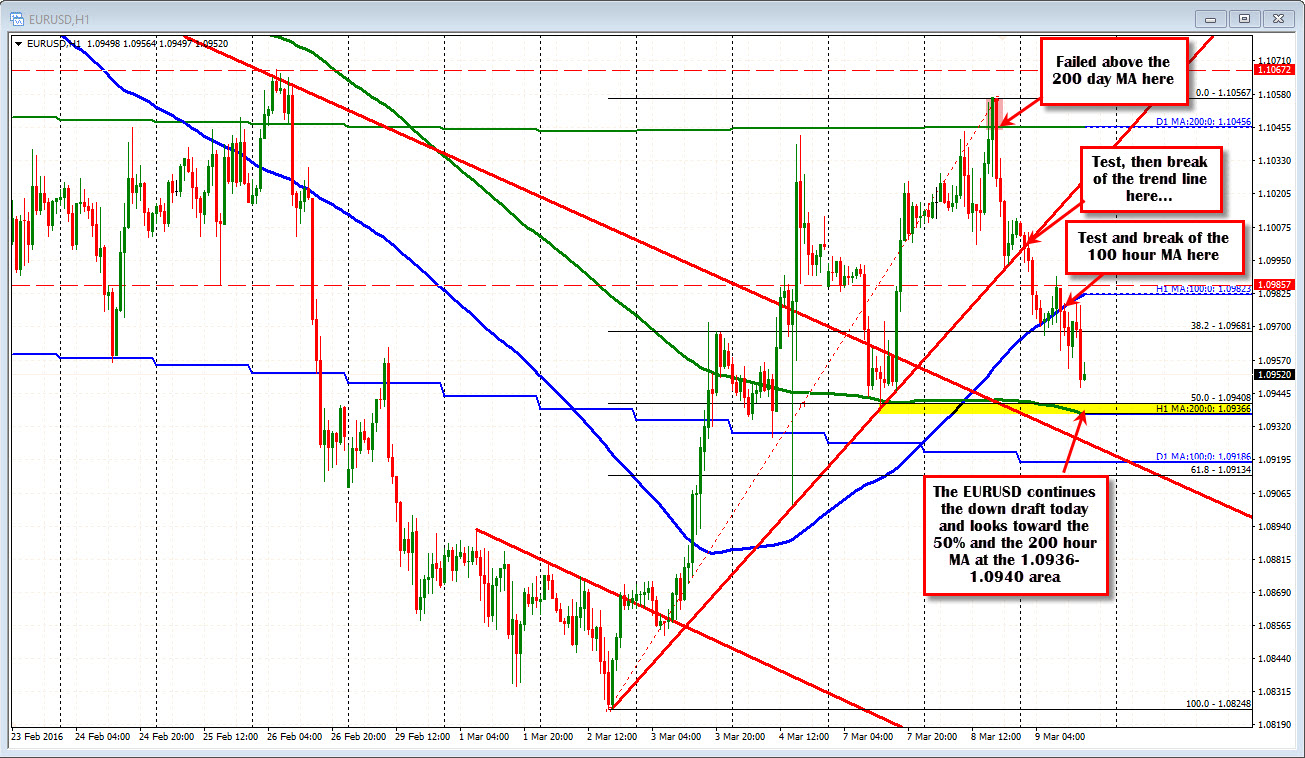

The pair tested to see if it could stay above the 200 day MA yesterday (see failure in the chart above), but traders thought it might be too high given the forthcoming ECB meeting.

That failue led to a test of trend line support in NY afternoon trading yesterday (see chart above).

Today in the Asia-Pacific session, the trendline was broken and the price moved to the 100 hour moving average (blue line in the chart above) and the 38.2% retracement area (around 1.09695 level). The European session has seen the price hold below the 100 hour MA - albeit in up and down choppy trading conditions.

The step process from 200 day MA to trend line, to 100 hour MA/38.2% retracement is traders doing their A-B-C's. In other words, the support targets are being tested, then taken out and moving to the next level.

So what is the next level?

Looking at the chart above, the 50% retracement and the 200 hour MA are with 4 pips of each other between 1.09366 and 1.09408. the swing low from Monday (at 1.0939) is between those two levels. So doing the A-B-C's that is the next target to test. Look for good support there on a test. That is a pretty good cluster of support. I would expect traders to pause and correct from that level today (with stops on a break below)