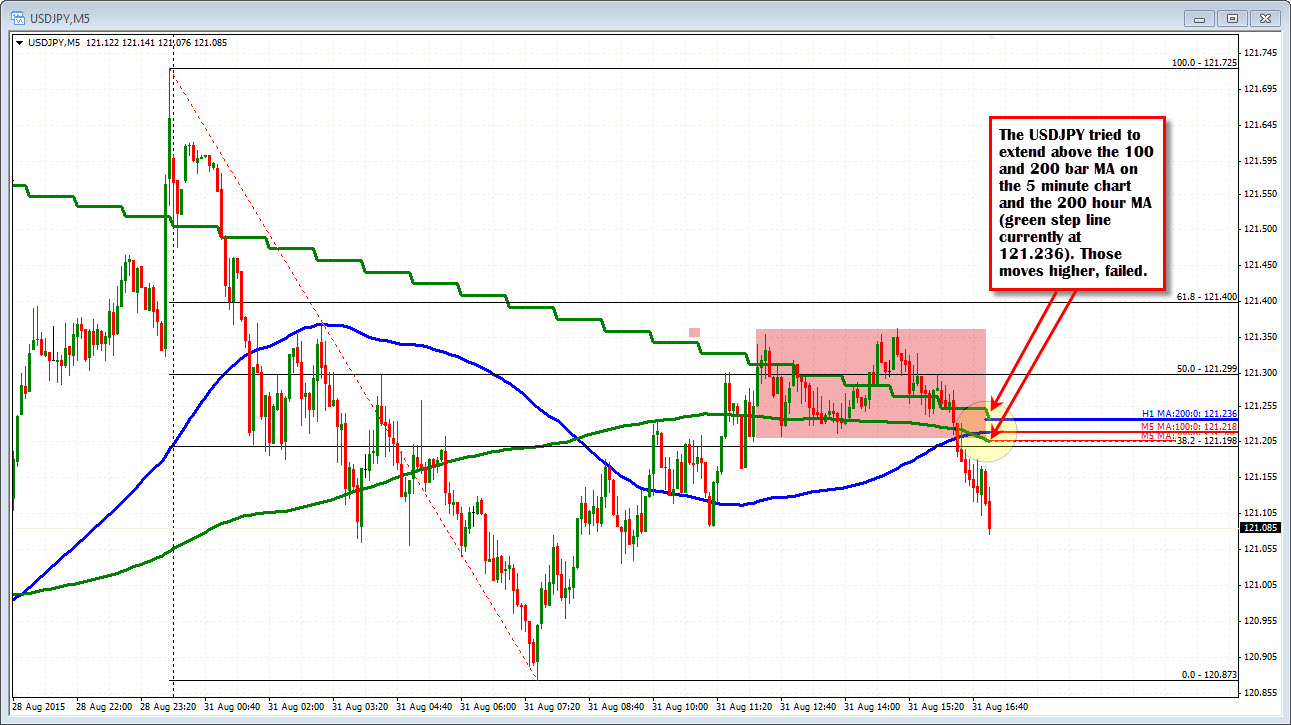

Europe session tried higher

The USDJPY tried to break higher in the European session, but failed.

The price moved above the 100 and 200 bar MA on the 5 minute chart. It moved above the 200 hour MA (green step down line in the chart above), but those "breaks" all failed.

The price for the USDJPY is now back below the 200 hour MA and both the 100 and 200 bar MAs (blue and green smoothed lines on the chart above) It is not running away, but will it solicit move selling? Technically it should.

What we know is risk can be defined against those technical levels above with the 200 hour MA at the 121.23 being a level for sellers to lean against, stay below, define and limit risk. If the price can stay below, we should be able to wander down toward the lows for the day. That is the hope given the technical picture for the day.

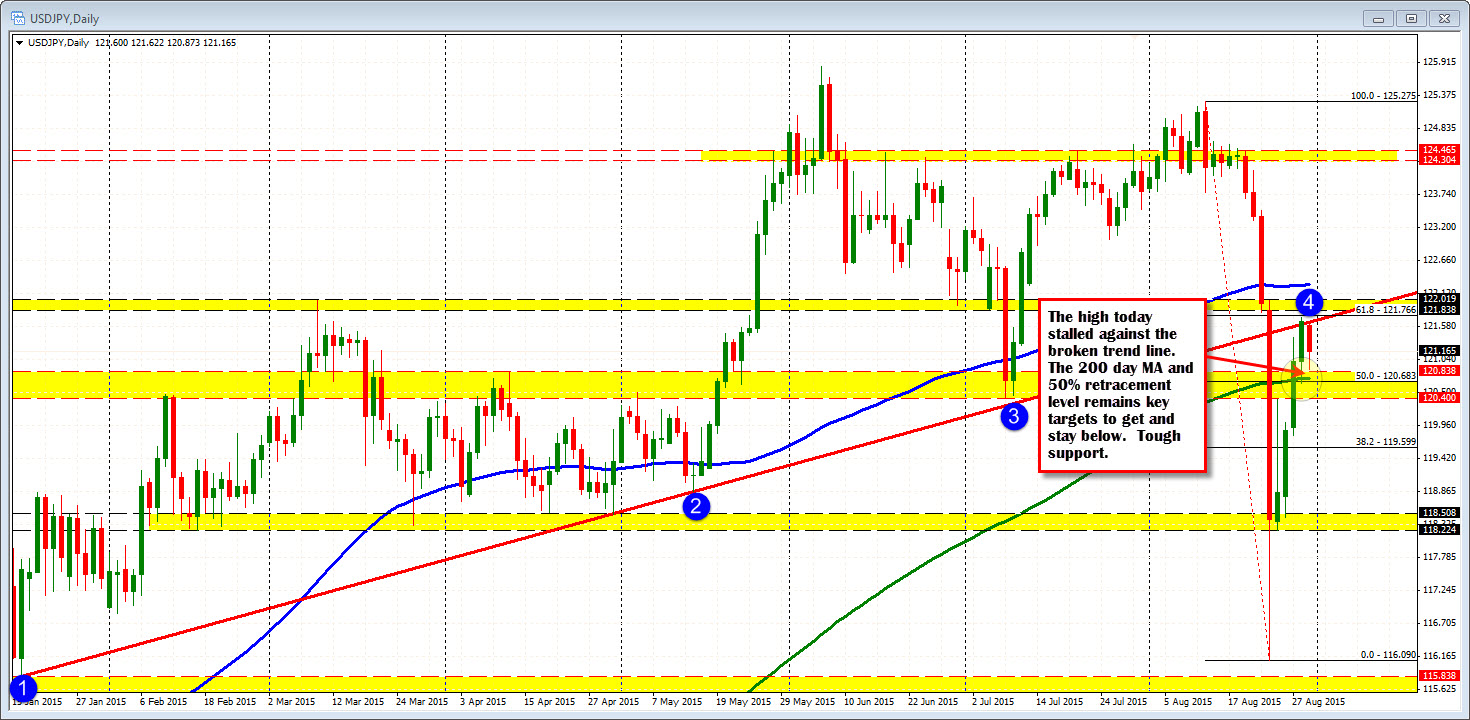

Looking at the daily chart below, the picture is showing some ambiguity. Specifically, the price has been able to hold resistance against a broken trend line at 121.68 (the high reached 121.62 today). ON the downside, the important 200 day MA and 50% retracement are at 120.73 and 120.68 respectively. The low today extended to only 120.87. Needless to say, if the bears are able to keep control (from the shorter term technical), a move below these longer term technical targets will be eyed.