The rally yesterday was impressive but most of the gains given back

The AUDUSD has a horrible GDP number on Wednesday that saw the price move down from around 0.7473 to a low of 0.7415. The low yesterday could not take out the weeks lows at 0.7410-13 and snap back rally began.

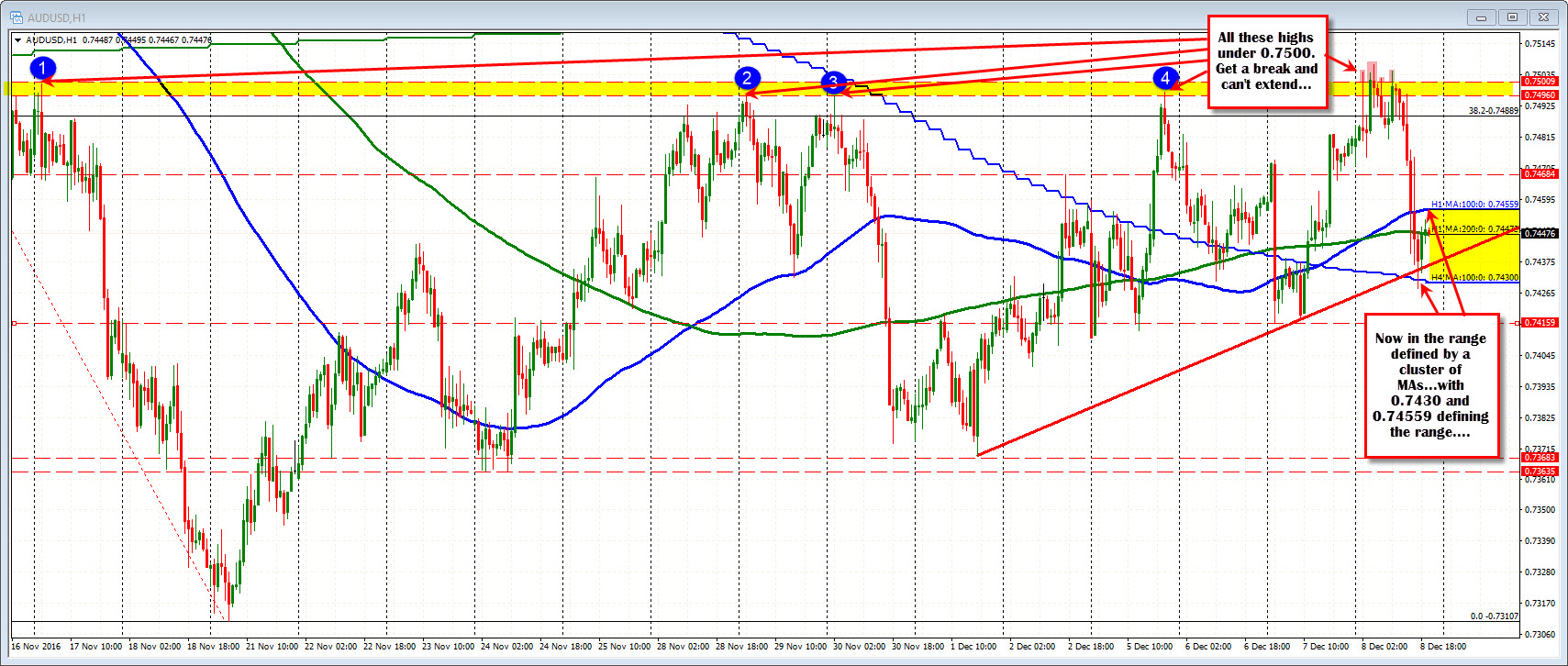

In trading today, that rally continued in the Asia-Pacific session. In the pprocess the price was able to extend above the 0.7500 level. There have been four separate swing highs that stalled between 0.7496 and 0.7500 point back to November 17. One would expect a break of the level would solicit additional buying. That was not to be. There were 4 separate moved above the 0.7500 level but each failed.

Finally, as the EURUSD started to take on heat to the downside (and the dollar started to move higher) the AUDUSD gave in to the gravity from the dynamics, and the price tumbled lower.

The move has taken the price to a cluster of MA lines defined by the 100 bar MA on the 4 hour chart at 0.7430, the 200 hour moving average of 0.7447, and the 100 hour moving average at 0.74559. The price has not had an hourly bar close outside that area over the last 5 trading hours. A move above or below should solcit more follow through momentum in the direction of the break.

The GDP was a shock (-0.5% vs -0.1% estimated for the quarter), but it was dismissed as a one off. In the new trading day, Australia Home Loans will be released with expectations for a -0.9% decline (vs 1.6% gain last month). Out of China, CPI and PPI will be released with both forecast at 2.2% YoY.