Tests intraday resistance

The EURJPY has trended lower in trading today and moved sharply lower since peaking early in December right against the 100 day MA (blue line in the chart below).

Today the fall took the price to another key technical level. This time on the other extreme. That level corresponds with the lower trendline connecting lows from September and November. That level today came in at the 128.67 level. The low today came in right at that level (see chart above)

Traders never really know what might happen next, but like at the 100 day MA above, when risk can be defined and limited against a technical level that is visible to many, traders will often lean against it and protect the trade with a stop on a break below. That is what happened at the lows today. That is what happened at the highs in December. The 100 day MA stopped the move higher. The price moved back below the 200 day MA (green line) and the sellers pushed the price lower.

So how do we know the low is in place? Again no one really knows but we can look at targets above that may shed light on the buyers interest.

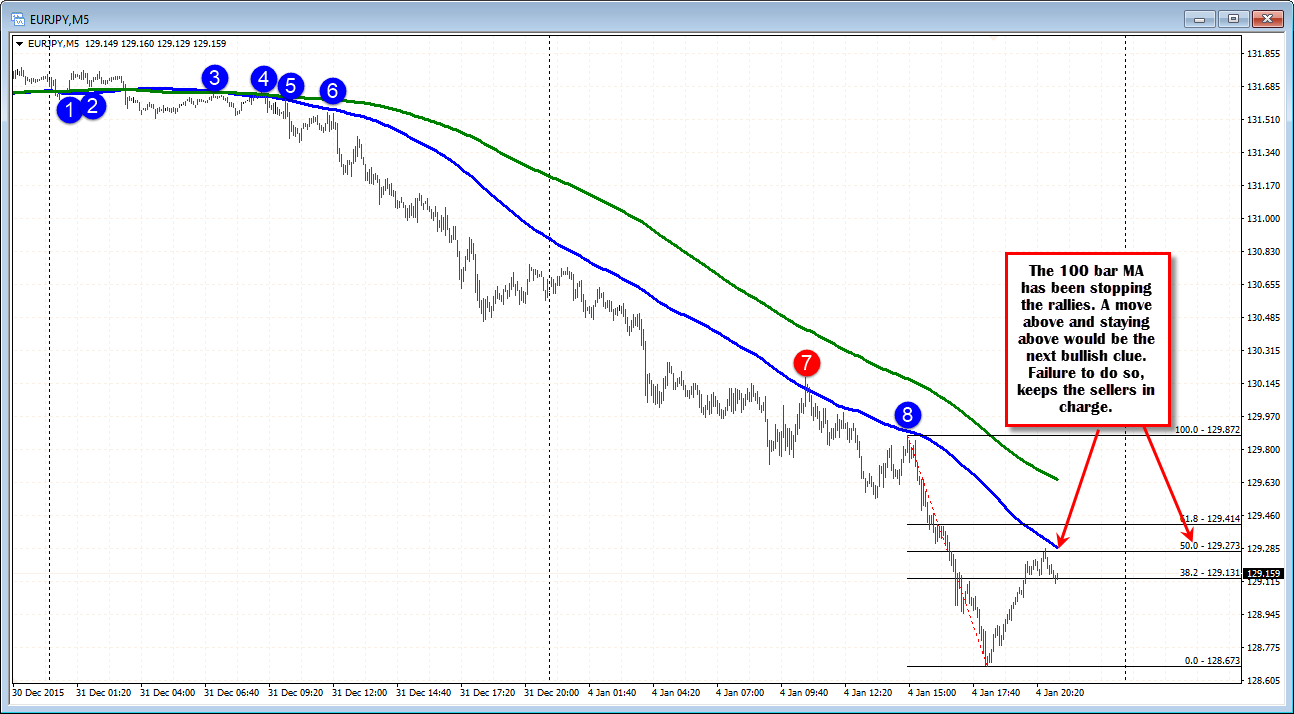

Looking at the 5-minute chart below, the pair has been trending lower over the last two trading days. That move lower has kept under the 100 bar MA on the 5-minute chart. There was one peek above the MA line earlier today, but that move failed (see red 7 circle below). The price just corrected up toward that same MA line again, but found sellers. The 50% of the last trend leg down (an acceleration leg) also provided resistance (at 129.27). If the buyers can not push the price above this area, the buyers are not taking back control. Getting above and staying above is key for the dip buyers.

The way traders figure out if a key bottom (or top for that matter) is in place, comes often from what counter trend levels can be taken out. If you have a clear roadmap - like we do on the 5 -minute chart - the price action and tools applied to that price action - give traders the confidence in the trade. Buyers from below know what they need to see happen, and those traders who are short, know what they don't want to see happen.