Employment report not so bad...

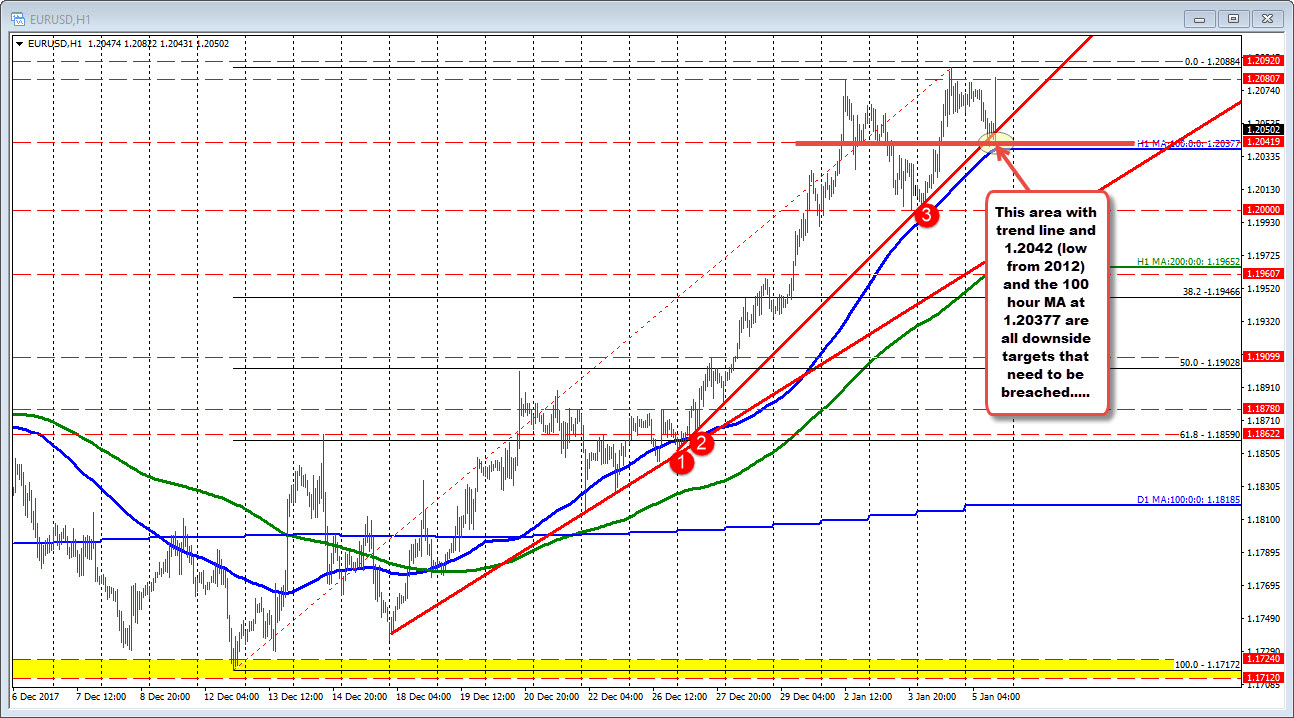

The EURUSD rallied on the numbers but the price could only get up to 1.2082 - that was just above the high for the day at 1.2079. The high from yesterday reached 1.2088. The high from 2017 was at 1.2092. That ceiling could not be broken, so the price has moved down.

The price is down to 1.2054 currently. There is a trend line at 1.2046. That line was breached by a few pips today but the price could not continue through the 100 hour MA at 1.20377. Getting below those levels will be eyed now if the bears are to take more control.

The numbers were weaker. Wages are still not kicking in, but with the unemployment rate at 4.1%, potential weather effects, talk that Amazon warehouse workers are not counted as retail employees, and perhaps the run up (dollar weakness) had gone too far too fast.

The price action is still within the confines of the ceiling above and the 100 hour MA below. Traders will be looking for the break at some point as that range is too narrow.

PS the 10 year yield dipped to 2.432%. It is back to 2.456%

US stock futures are keeping gains. Nasdaq up 26 points. Dow up 81 points and S&P futures are up 8 points.