ECB/Draghi on Wednesday

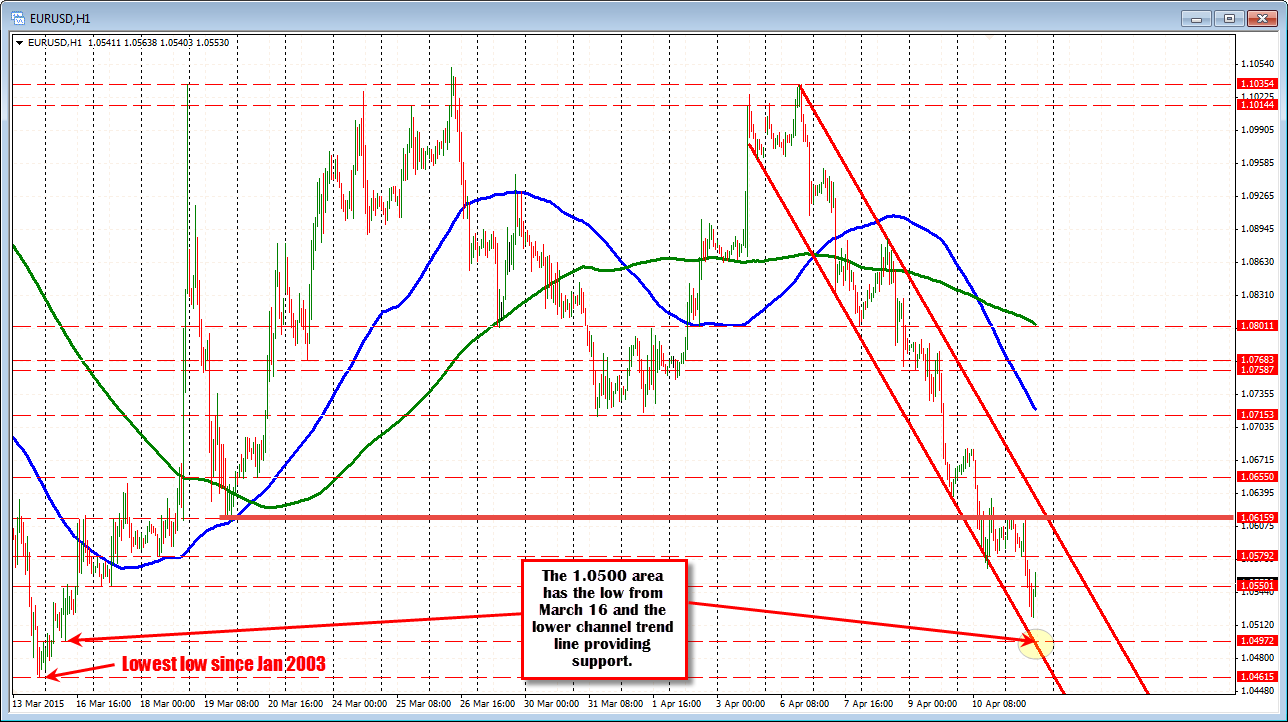

Although the big event will be Draghi's press conference following the ECB rate decision on Wednesday, traders have stepped down the price of the EURUSD in trading today. If the price can stay below the Friday close of 1.0600, it would represent the 6th straight day down for the pair. In that run, the price has moved from a high of 1.10347 to the low today of 1.05202 (515 pips).

Looking at the hourly chart, the pair has been trending in a channel. The current bottom trend line comes in at around the 1.0500 level. A move below that level and the low from March at the 1.04615 is the next target. Today the high stalled near the low from after the FOMC spike and subsequent tumble on March 19th at the 1.06159 level (the high came in at 1.0618).

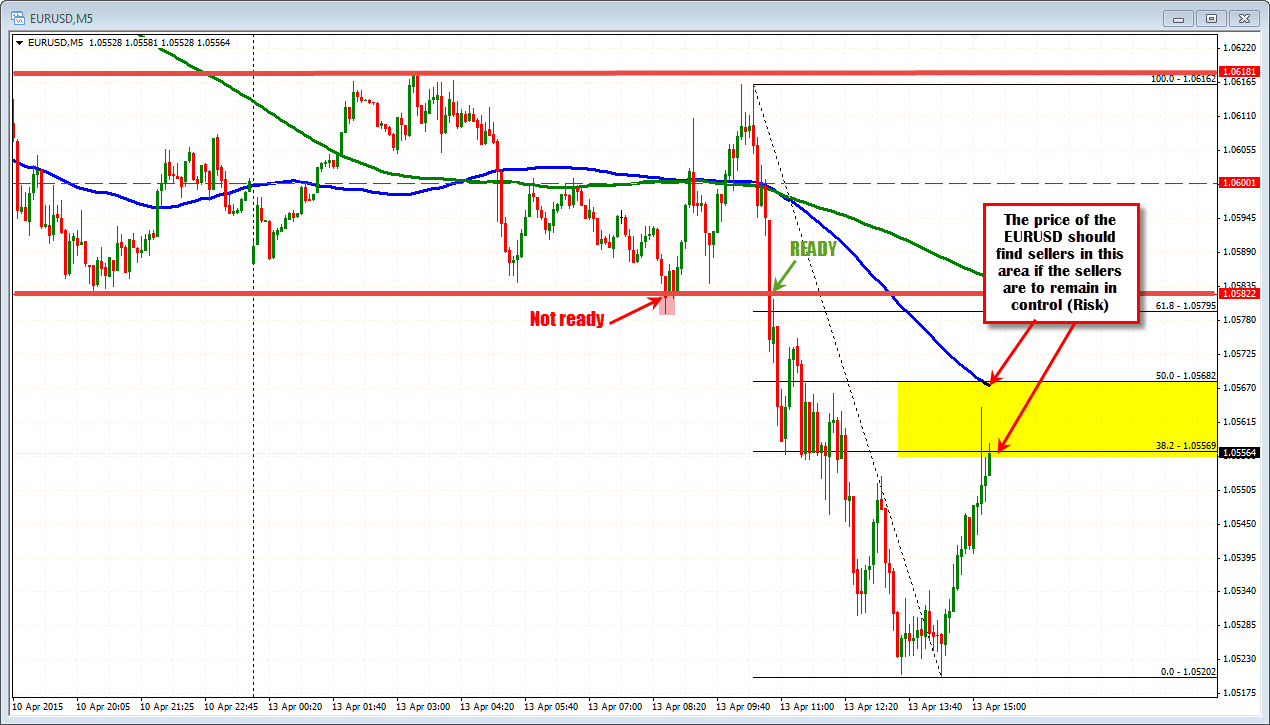

Although lower, there is a bit of a correction as the NY traders enter for the trading day. The pair is entering the correction zone defined by the 38.2-50% retracement. The 100 bar MA is in the area as well. If the sellers are to remain in the dominant role, the pair should find sellers in this area. A move above and traders will likely look to pare positions.

There are no major economic events out of the US today until the monthly budget statement at 2;00 PM ET.

Moving forward to Draghi, with QE started, rates at lows, stock markets moving higher it will be hard for Draghi to not speak with some sense of hope that the bottom is in in place. However, he could also express concerns about the risk of slower global growth and be realistic about the depths of where they are coming. Does he really want to strong EURO after all that has been done to get it down? So there could be up and down volatility on Wednesday as the press conference progresses and the story is told.