Why not. The Fed is going to tighten in December...probably

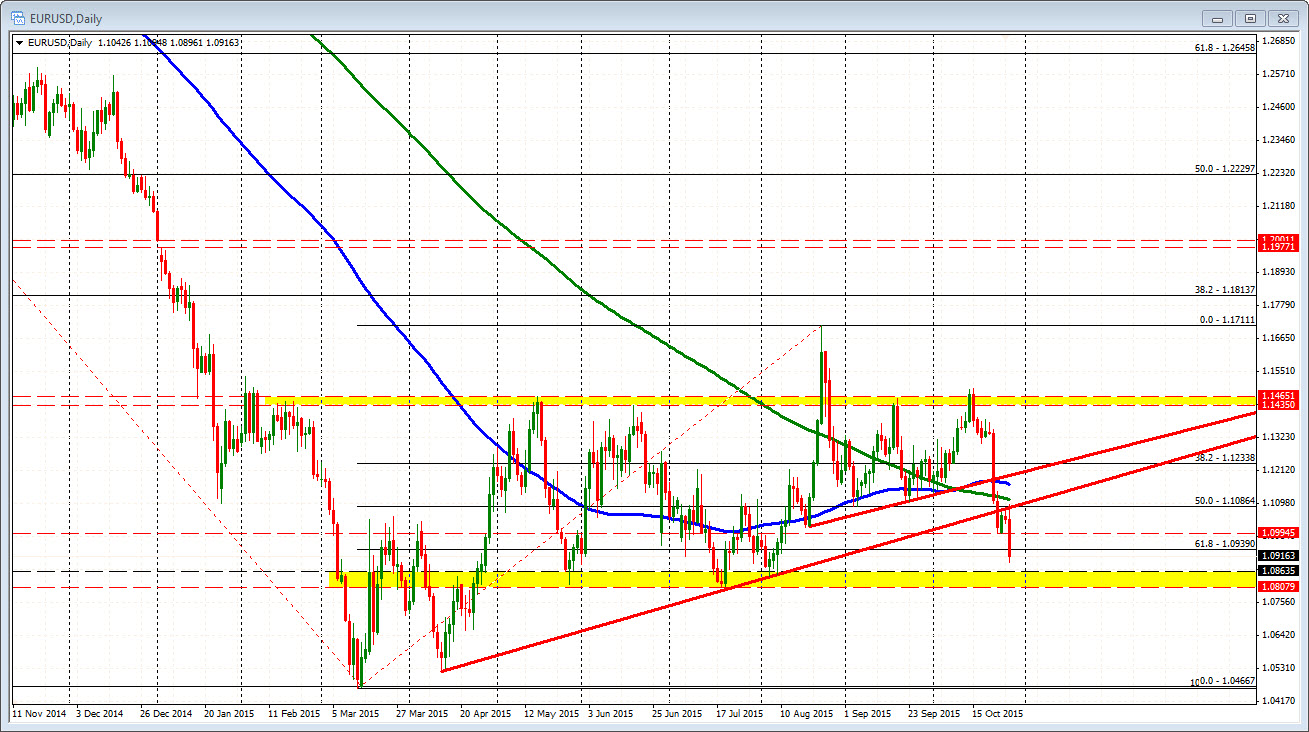

The EURUSD is making new lows and took a "look-see" below the 1.09000. The Fed after all signaled that they will be more serious "next meeting". Of course they may not, but by saying "next meeting" they made the meeting live again, and the market is reacting.

Technically, the next targets comes in at the 1.08635 level and that support target area goes down to 1.08079. The area is the range where there have been a number of lows going back to May (see daily chart).

Fundamentally, the Fed talked about a "solid" rate of increase in business investment in "recent months". A measure of business investment is Durable Goods orders ex defense and aircraft. Yesterday, that measure fell by -0.3% in September. The August release was revised to -1.6% from -0.2%. Just saying. Here is a chart of the seasonally adjusted value of that business investment. Maybe they have some other measure they look at but this does not look all that hot in "recent months" at least. Fitting the square peg in the round hole perhaps, but heck the Fed can tighten. Like the easy conditions, a wiggle here or there in rates, has not had that much of an impact of late to the economy (the GDP is looking like 1.1% according to Atlanta Fed tracking). I would expect a tightening will really not do much either. So as Adam says, don't fight the momentum.