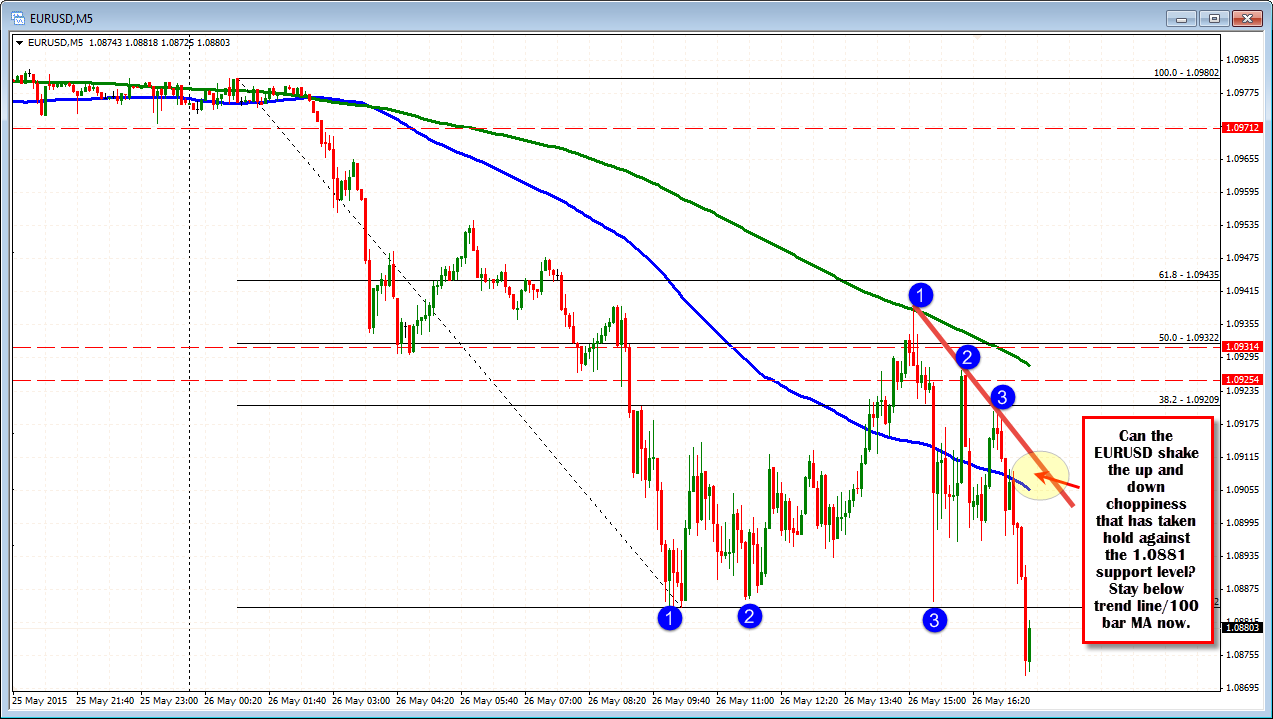

The 4th time the charm, but the EURUSD is not in too much of a hurry to head lower.

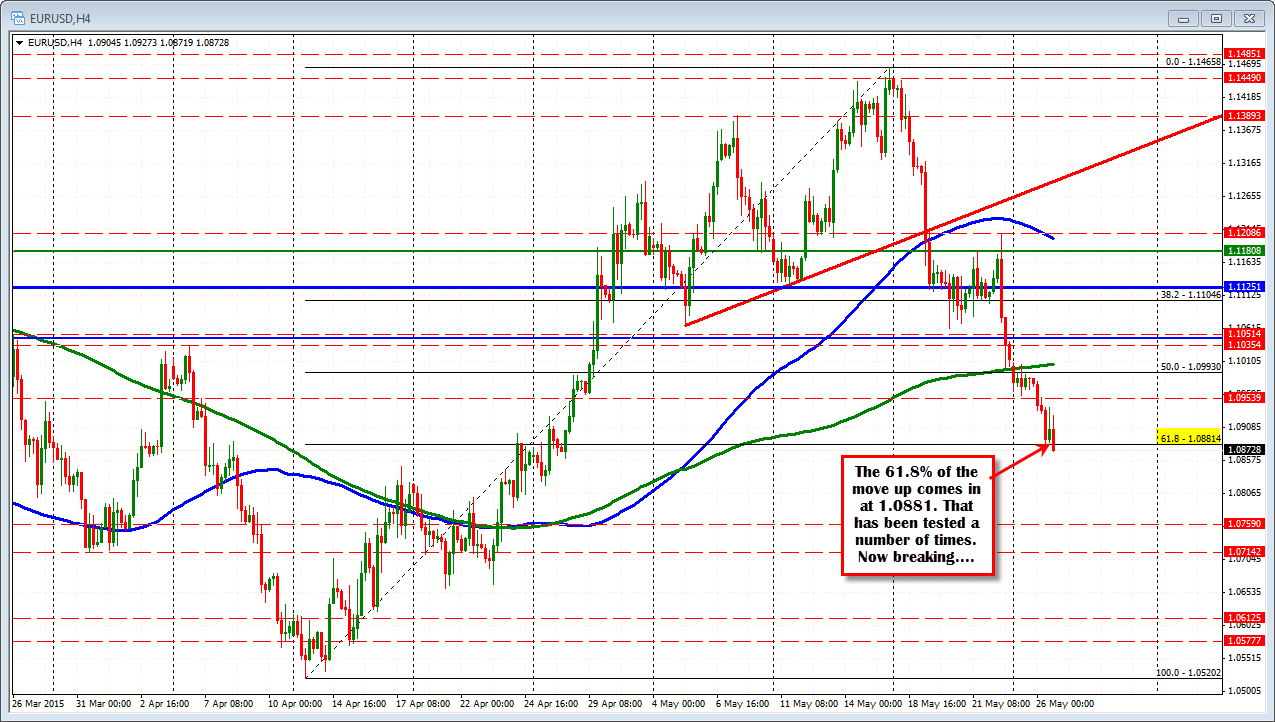

The 61.8% of the move up from the April low is being tested for the 4th time and has been broken. The level came at the 1.08814. Prior to the break, the line was test on 3 separate occasions. Better US data (durable goods, S&P Case Schiller, new home sales, consumer confidence, Richmond Fed) has helped contribute. The pair has a 113 pip trading range. The average is 141. So if the momentum can continue, there is room to roam.

The 5 minute intraday activity in the NY session has not been a thing of beauty to be honest. Apart from the last push lower, traders seemed more intent on buying dips. Three successful test of the support target can do that to you. This break is a chance for the market to shake the choppy cobwebs away. The best case scenario would be to stay around the 1.0881-84 area, but already that is not happening (the price is back above that area). The next best thing for the shorts is to put up with a correction toward the 100 bar MA (blue line at 1.0905)/trend line (at 1.0911 currently). Both are moving lower.

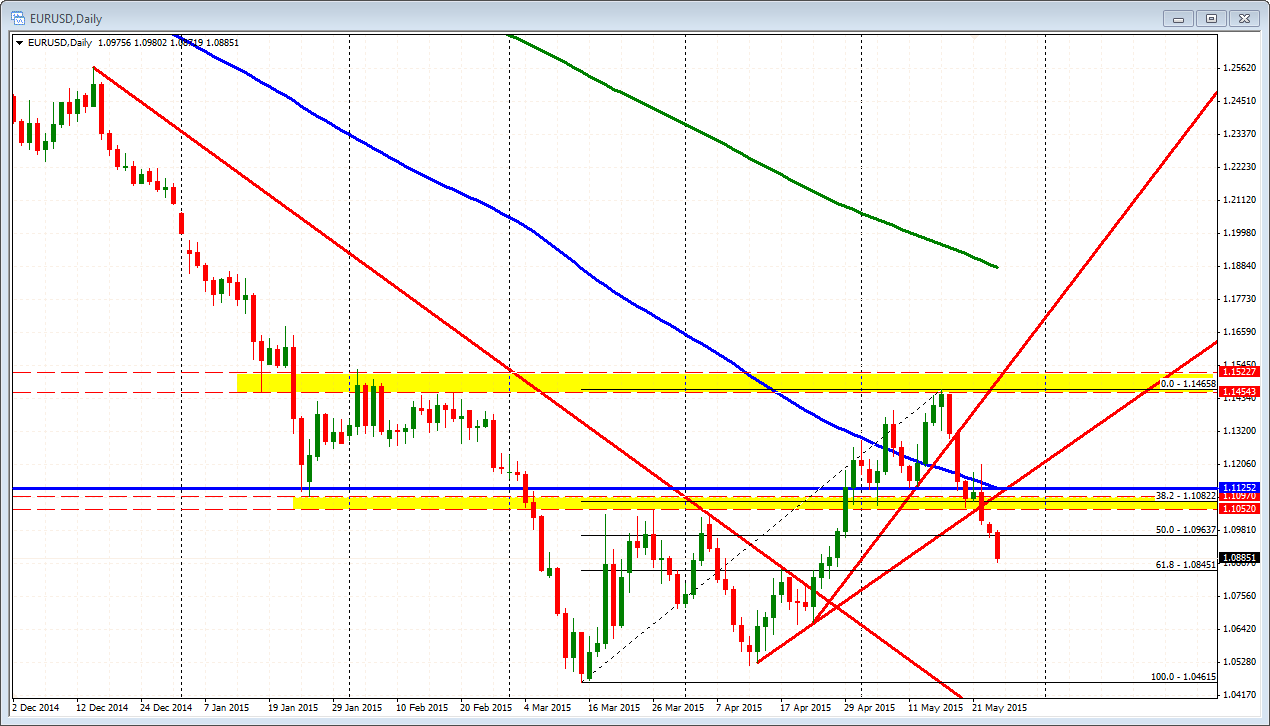

Since peaking at the 1.14658 level on May 15, the price of the EURUSD has moved down nearly 600 pips. Looking at the daily chart the 61.8% of the move up from the March 2015 low comes in at 1.0845. IF the sellers can squeeze some more out of the market to the downside today, that might be a nice target to call it a day. Patiently waiting.