100 hour MA holds on the 1st look

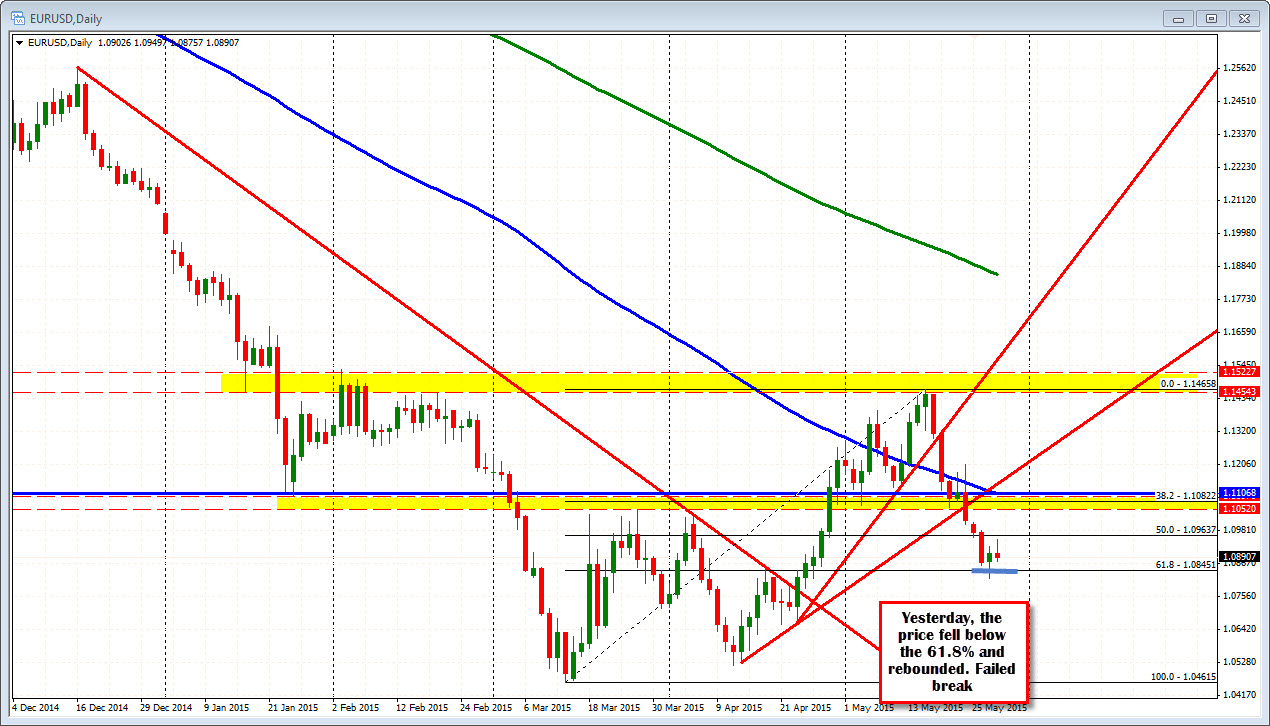

Yesterday, the EURUSD fell to new lows for the May decline, and closed higher on the day - but not by much. In the process the price fell below the 61.8% target at the 1.0845 (see daily chart) then ripped higher (see hourly chart). The pair waffled back and forth into the close. KEYS: failing below the 61.8% level. Closing higher.

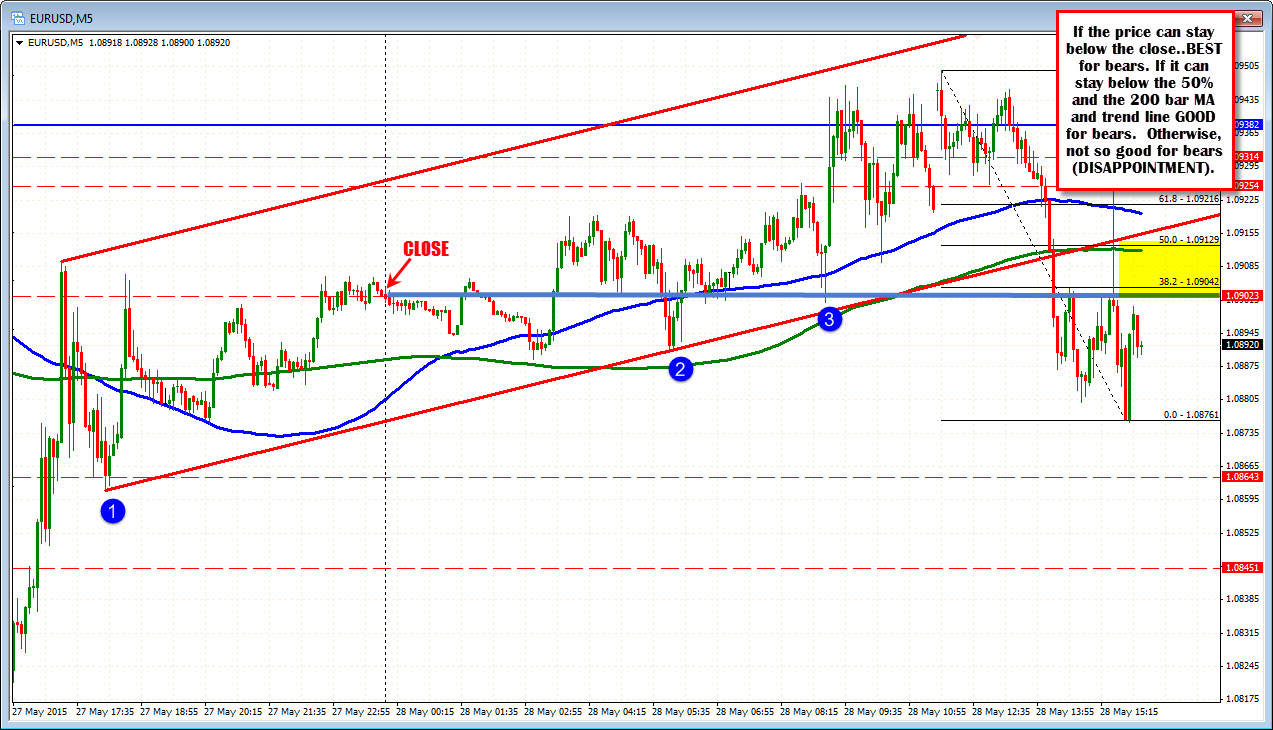

Today, the action has once again seen up and down volatility with an upward bias until the price tested the 100 hour MA (blue line in the chart below). The MA attracted sellers, the US initial claims data was about as expected and the pair has seen a further decline. The close yesterday came in at 1.0902. The pair has fallen below that level in the last few hours - reaching a low of 1.0975. The low to high trading range today is 75 pips. That is once again light compared to a 141 pip average over the last 22 trading days (around a month of trading). There is room to roam. So what are the keys today? KEYS: 100 hour MA held like a charm. The price is below the close. The range is narrow.

The pair is nearer the low so the expectation would be for further weakness. The next targets below the low would look toward the 1.0862 and then the 1.0845 level again (see hourly chart above). What would change that picture, i.e. give it more upside potential? I would start to question the fall, if the pair could move above the 50% of the move down. The 200 bar MA is at the level too. The best case would be staying below the 1.0902 close from yesterday. Apart from the failed up and down move after the initial claims, that level has been a little ceiling in trading over the last few hours. So risk levels are set. There should be further declines, but traders must realize too that yesterday's action - it had its chance below the 61.8% level - was a bit of a disappointment. So be on your toes for the potential choppy rebound (like we saw yesterday). Until the buyers can show they mean it (by at least getting above the close and staying above), the sellers are still in charge though.