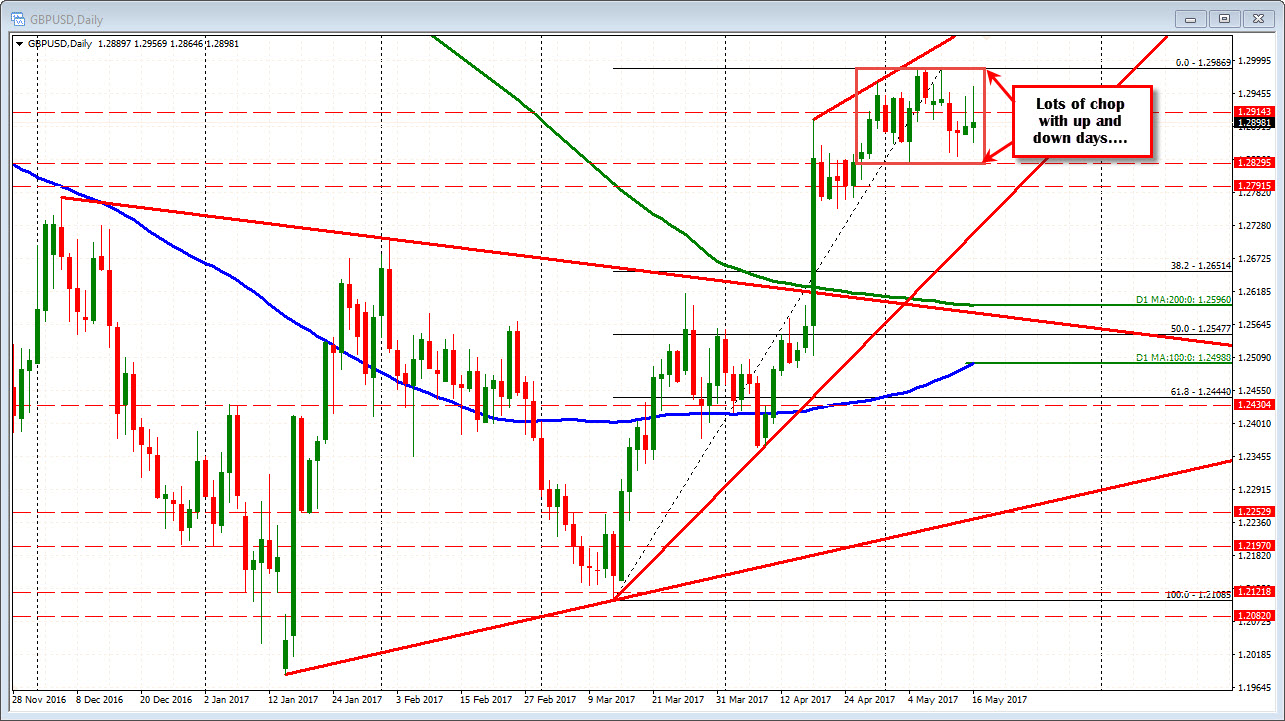

Red Box lower extreme holds.

How do you make sense of the GBPUSD?

Looking at the daily chart, the pair has been trading up and down in May (and going back to April). It is not pretty.

Drilling down to the hourly chart, there is the same up and down chop. Is there more info traders can use? Sure.

In my recent technical posts for the GBPUSD, I have been breaking up the ranges into boxes. The recent box (Red Box) has a low at 1.2860 and high of 1.2987. The last 14 days has mostly traded between those extremes. At the high there has been three peaks near the high extreme a 1.2987. On the downside, the 1.2860 area has 7 different swing lows. There have been 3 moves below the 1.2860 level over the last 14 trading days (red shaded areas in the chart below) but each has failed fairly quickly.

So off the hour chart, the Red Box is defined. Today, traders leaned against the 1.2860 low - buying at 1.2864. I would expect stops on a break of the level if breached. Buyers on the dip are winning. The price is trading 1.2900 currently.

Is there anything in between the two extremes?

On the hourly above, the 100 and 200 hour MAs come in at 1.2904 and 1.2209 respectiely. If the price can get above, it should stay above if the bulls want to take control. If it fails - like it did on the move higher today, look for the buyers to switch to sellers on that failure. It is simply what comes with the territory of this consolidation phase. Traders need to protect themselves. They will use technical levels to work through the fog. We are currently testing the 100 hour MA (blue line).

Anything from the 5- minute chart?

When the market chops, drilling to a shorter time frame can show what the market is feeling. Sometimes it gives clues as to the bias (even if the bias does change).

Looking at the chart, the GBPUSD is trading near the 100 hour MA (as per above) and also the 100 and 200 bar MAs on the 5-minute chart (see blue and green lines). At the 200 hour MA at 1.29209 (see overlay green line on the chart below), the market has tried to break above that MA line, and stay above, but when the break fails, the buyers lose interest (or so it seems).

In summary, the GBPUSD chops and that makes trading touch. However, "on the wide" there is support at 1.2860 and resistance at 1.2986 (the Red Box on the hourly).

In between sits the 100 and 200 hour MAs (at 1.2904 and 1.29209 currently) which have recently seen moves above the 200 hour MA fail (yesterday and today).

As a result, those MAs are a resistance area for those who want to sell.

For bulls/buyers, the price needs to get and stay above each MA line and stay above if we are to make a run at the higher extreme again. If there is a failure on a break higher, don't expect the buyers to hang around. The last two times failed. It can happen again. Traders don't trust choppy markets and they tend to use the technicals to show their distrust.