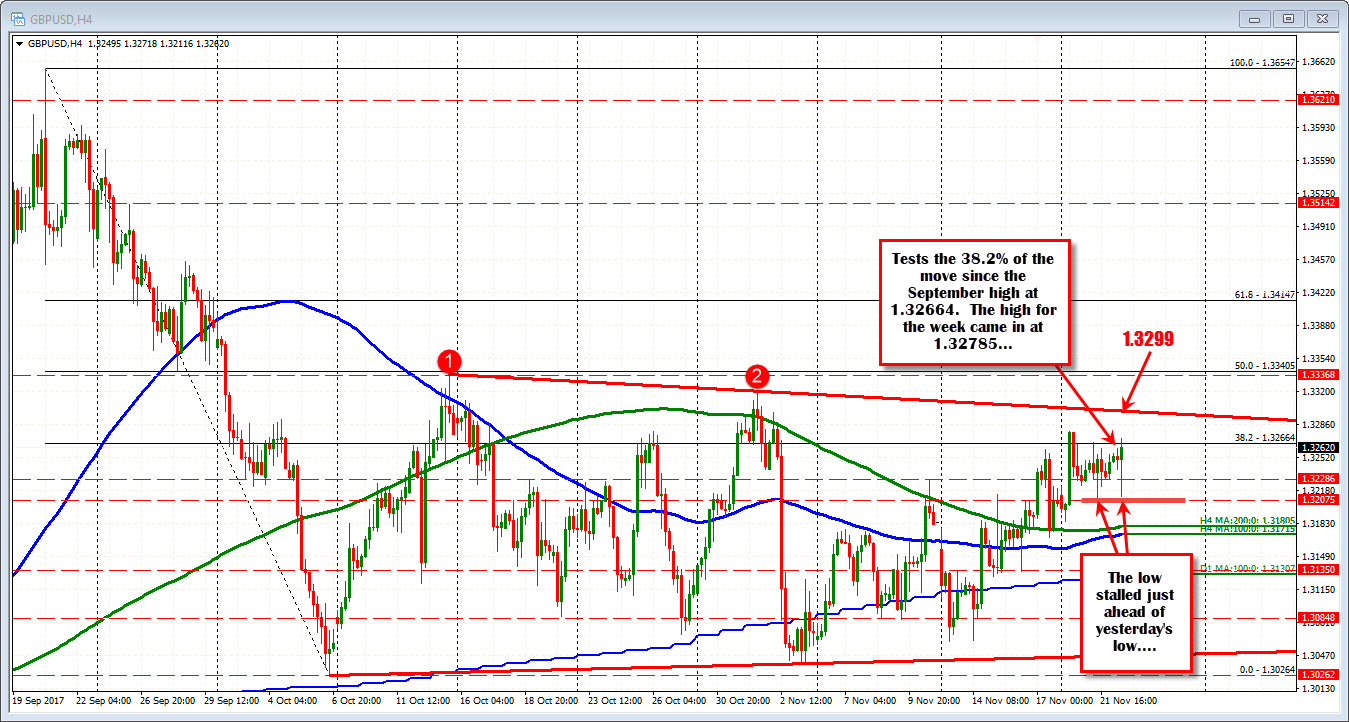

Looks toward the high for the week at 1.32785

The fall on the budget comments took the price near the low from yesterday at 1.32079. The low price today reached 1.3211.

Then the squeeze was on and the price reversed higher, taking out the earlier high for the day. The peak has reached 1.32718. The high for the week comes in at 1.32785. A topside trend line of the up and down, non-trending trading range since the end of September comes in at 1.3299.

If the buying can continue (going foward), the swing high from November 1 comes in at 1.3320. The high from October 13 comes in at 1.3337. That level is very close to the 50% retracement of the move down from the September high at 1.33405. That area (at 1.3337-40) will be a tough nut to crack on the first look at least (i.e. expect some selling).

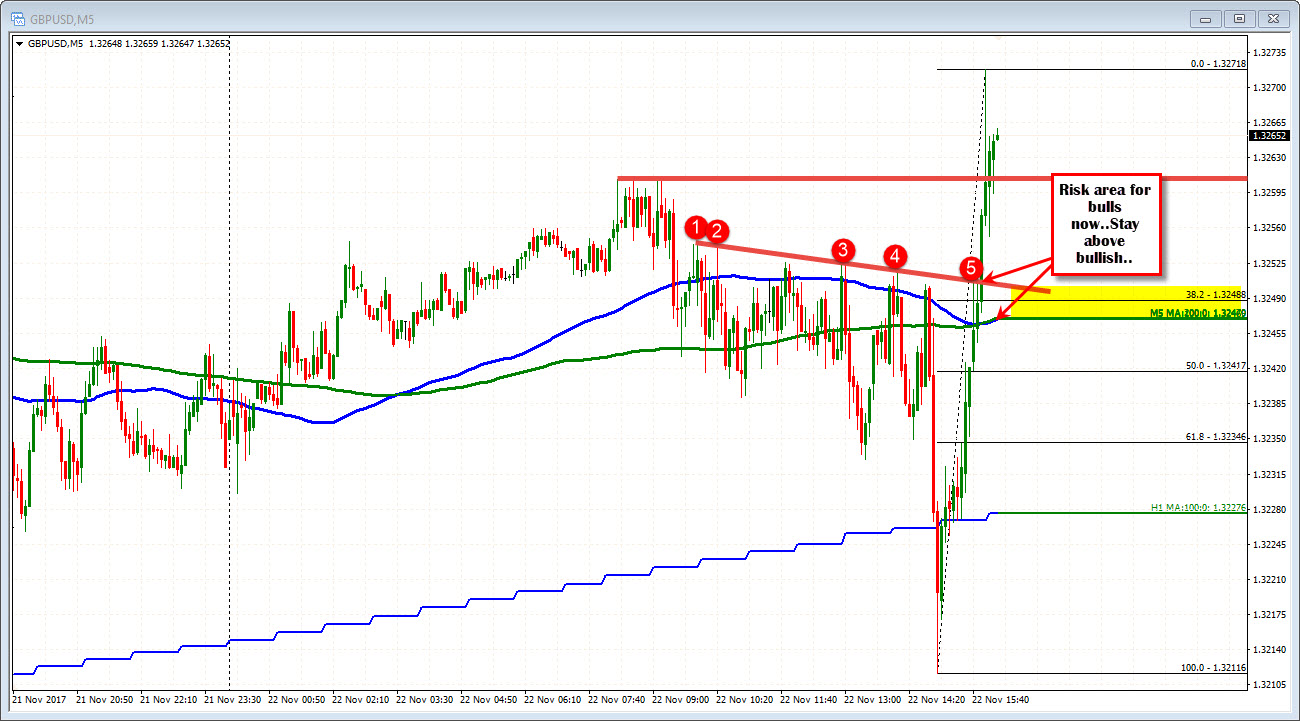

Drilling to the 5- minute chart, the down and ups today make things messy,but there is a trend line that had a number of tests. The break above, led to more momentum higher. That line and the 100 and 200 bar MA (blue and green lines) are risk for longs (the 38.2% is also in the area). I would think, that a move below would be disappointing to the longs now.