Traders leaning against the level

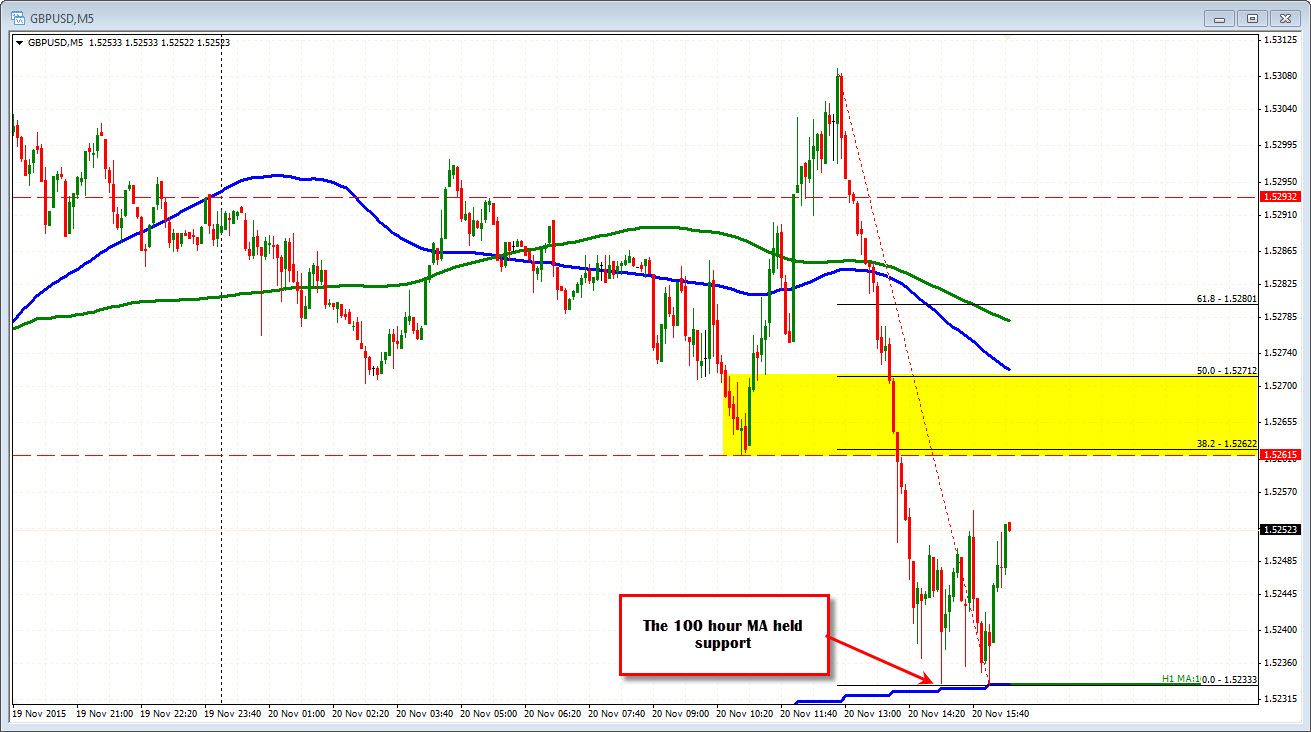

The GBPUSD has some traders leaning against the 100 hour MA at the 1.5233 level. The pair yesterday had early buyers against the level after the weaker retail sales (but only by a few pips short of the MA level). Today the MA was touched at 1.5233. We are back up to 1.5250.

Yesterday, the GBPUSD tested the 200 day MA (Green step line in the chart above) at the 1.5339 level. The high reached 1.53349. Close enough.

What now?

Looking at the 5-minute chart, the correction off the 100 hour MA has been choppy. The 38.2% of the steady trend move lower comes in at 1.5266. The swing lower in the European morning session came in at 1.52615. Buyers against the 100 hour MA have that as the next target and traders should have a battle against it. A move above would then look toward the 50% at 1.52712. The 100 bar MA on the 5-minute chart is working toward that 50% level (the 200 bar MA - green line - is also moving that way.

Holding under the 200 day MA yesterday. Holding support at the 100 hour MA have defined a larger range. With little data and flows in control into the weekend, anything is possible. However, support holds the line. Buyers found a level to lean against.