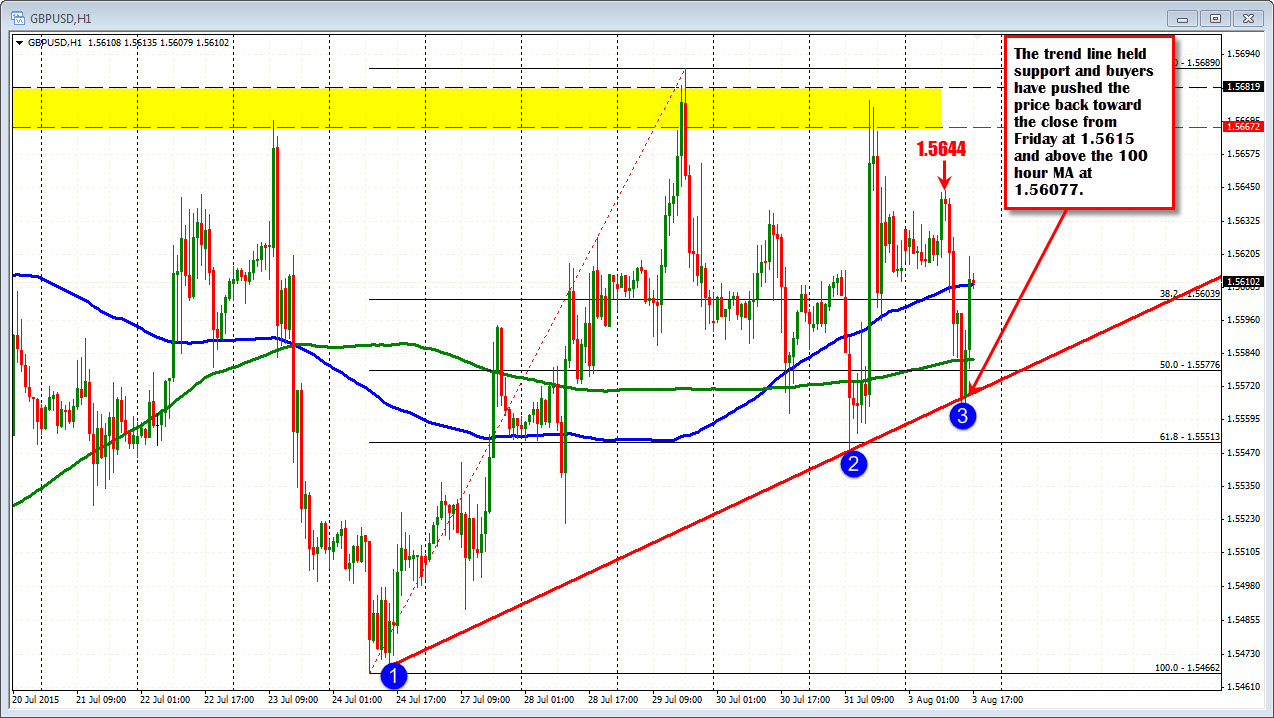

Holds trend line below

Technically, the GBPUSD moved steadily lower in the London morning session. However, it held trendline support in early NY trading and that has helped push the pair back higher in NY trading. A weaker than expected ISM Manufacturing index (released early), has also helped to weaken the USD.

The pair has now moved above the 200 hour MA at the 1.5518, the 50% of the days range and just now the 100 hour MA at the 1.56077. The close from Friday at the 1.5615 and the 200 bar MA on the 5 minute chart also at 1.56154 are the newest levels to be breached (happening as I type). The targets higher are being checked off one by one.

The next targets come in at the 1.5628 and the high for the day at 1.5644. The 1.5628 is the midpoint of the move down from the June 18 high.

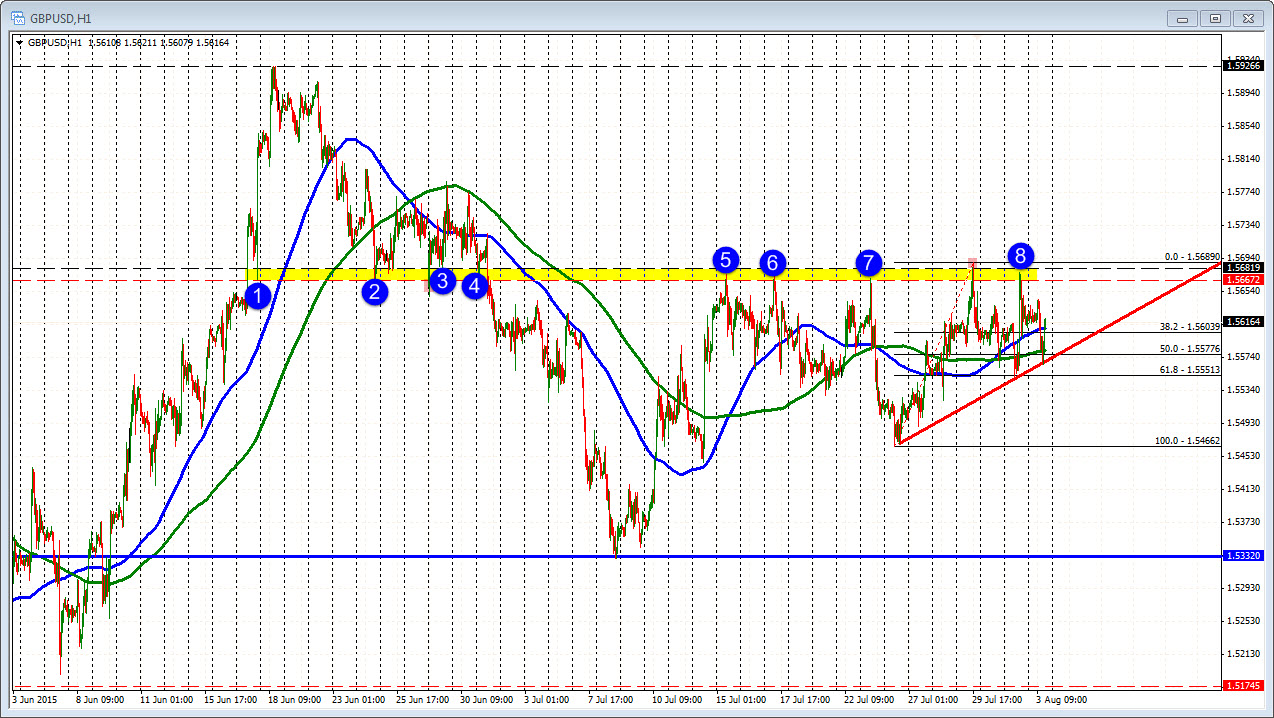

So the shorts from earlier have given up on their run. The action does seem a bit random though and controlled by the short term flows in summer Monday trade. With the Fed doing it's best to find a way to tighten in September, but with weakish data of late there is the potential for rallies to be sold and dips to be bought. It is a question of where are the best levels to lean against. Look for any failures perhaps? A move back below the 1.56077. If we don't get it (with momentum, be patient for higher levels. We could even head all the way up toward the 1.5667-82 which has been a floor/ceiling for the GBPUSD going back to mid June (see chart below).